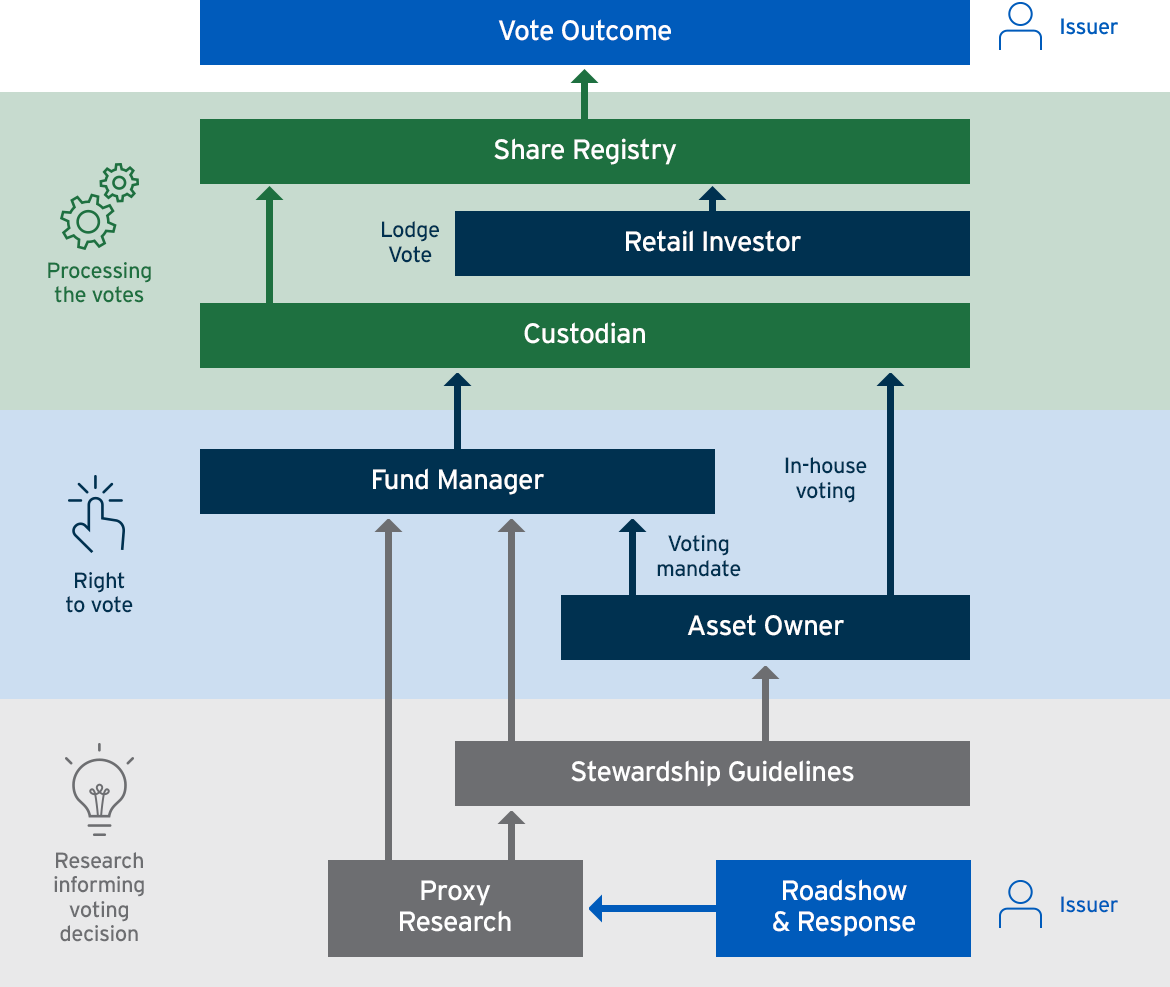

The profiles of share registers are often changing, and so too are the voting authority and proxy advisor influences on your register. The fund manager with the investment mandate is often distinct from the stewardship manager who retains the voting mandate. In fact, the majority of asset owners vote their own shares or provide their voting instructions to their investment managers1. This is a shift to in-house voting and the trend is expected to continue in relation to both voting and in-house assessment of ESG risks and opportunities.

Therefore, understanding where this voting authority lies is an important first step in securing a positive AGM outcome.

Proxy advisor influence

The next step is calculating the influence of different proxy advisors on voting decisions. Proxy advisors research and assess the performance and disclosures of issuers to provide investors with recommendations about how to vote and hold Boards to account. Many investors do not have the resources to dedicate to in-house governance research, so they take the recommendation of proxy advisors at face value. Others use this research to inform and supplement their own stewardship codes.

Knowing what percentage of your register considers ISS, CGI Glass Lewis, Ownership Matters or ACSI in their voting decision can help you prioritise engagement and address key issues with investors.

Once a proxy advisor publishes their research, that need not be the last word that investors hear. As an issuer, you can respond to the research with your own paper and correct misstatements, provide additional justification and rationale for decisions and provide your investors with greater symmetry of information for their voting decision. Knowing the voting authority on your register can help you allocate resources to these responses, or indeed help with the decision making for an outbound investor engagement campaign.

Recommended Actions:

The right contact

The first step with engagement is ensuring you are speaking with the right person. When it comes to engaging with investors, Australian companies are quite savvy with communicating their business strategy to the right investment decision makers. What is less obvious to many is that the people making the investment decision are often separate and distinct to those making the voting decision.

During governance roadshows, investors and stewardship teams generally want to meet with the Chairman rather than senior executives. The conversation is often focused on key committee decisions like nominations, remuneration and increasingly, on Board oversight of environmental and social issues. It is through the ESG lens that investors can gain insight into the Board's preparedness and suitability to sustainably oversee and protect the future value of the company.

It is important that the Chairman is armed with information about each investor prior to the engagement. What are the themes and sentiments the investor has expressed throughout the year during their engagement with the investor relations and executive teams? Have you addressed the concerns raised in the previous meeting? When directors have the full picture of engagement, they can more effectively demonstrate that investor concerns are being adequately managed and prioritised by the Board.

Proxy advisors are also open to meeting with issuers. It is important to book these meetings well in advance of your AGM.

AGMs are often an opportunity for shareholders, including activists, to advocate for change and have their voices heard. It is therefore worthwhile meeting with some of Australia's more prolific activists including Market Forces, ACCR and ASA. Hear their concerns, identify if you are in their line of sight and most importantly take your opportunity to articulate your governance process and reasoning.

The feedback loop

While it is always better to engage with investors ahead of your AGM, if you receive an unexpected poor outcome on a director election or the remuneration report, or see significant support for shareholder-sponsored resolutions, it's important to understand shareholder motivations.

Engagement post-AGM is an opportunity to express to shareholders that their voice is meaningful and being heard. The business strategy need not necessarily change as a result, but you can communicate your strategy or rationale and open the door for more productive outcomes in future years.

Shareholder resolutions are receiving increasing support and act as a litmus test for investor perception and appetite for action on issues such as climate change, native title protection and corporate misconduct. As the support rises, so too should the attention that Boards and management pay to shareholder concerns.

Flow of AGM Votes

Recommended Actions:

Active Capital

Increasingly important is to stay abreast of changes to investor sentiment, stewardship guidelines and investment criteria.

- Has a substantial holder on your register pledged to reach carbon neutral by 2050 across their portfolio?

- Have they signed up to HESTA's 40:40 Vision?

- Have they indicated that they want to see disclosures against specific ESG frameworks?

- Did they vote against the head of your nomination committee for failure to maintain a diverse Board and executive team?

With ESG assessment coming in-house, more time and resources are being dedicated to ensuring that investors are making responsible decisions in a changing world. This is reflected in capital allocation and voting outcomes.

Index Funds

The only option for index funds to protect the long-term sustainability of their funds is through engagement, encouragement and sanctions via voting. The three largest index funds all release annual updates of their priorities and voting guidelines and they are constantly evolving and expanding across all markets.

Currently, the expectations for Europe and the US around ethnic diversity transparency and representation are higher than the expectations on Australian companies, but it is only a matter of time before the same standards are applied in the Australian market. Monitoring global trends is an important aspect of anticipating future areas of shareholder concern.

Proxy Advisors

Proxy advisors aim to provide research and voting recommendations reflective of their clients. They offer a base governance recommendation but allow investors to apply additional 'lenses' to deeply scrutinise environmental and social (E&S) agendas. This is of interest to a broad range of sustainable funds and investors, including signatories to the United Nations Principles for Responsible Investment (UN PRI) which includes nine of the 15 largest Australian superannuation funds. These policy overlays cover climate change, sustainability and responsible investment frameworks which are updated annually.

Annual voting guideline documents provide issuers advanced warning of changes to voting decision processes and key focus areas. There are distinct guidelines for each market allowing for local nuances but this does not stop the evolution of good governance each year, reflecting global sentiment.

Recommended Actions:

Investors care about ESG. This is evident in the:

- More than 3000 institutional investor signatories to the United Nations Principles for Responsible Investing;

- Growing support for shareholder-sponsored ESG resolutions;

- Growth of responsible investment in Australia, now representing 37% of the total professionally-managed assets under management2.

Ratings and Rankings

There are a wide range of ESG ratings companies available for investors to help assess your performance against your peers. Some of these use publicly available data whereas others will ask for your input via complex, lengthy surveys. While this can require significant resources to complete accurately, it is an important task to ensure that you receive a fair score, reflecting your company's efforts on ESG.

It is helpful to know which ratings and rankings your investors pay closest attention to; they may even have their own proprietary rating methodology that takes preference. You are then better positioned to allocate your resources where they will have the most impact.

Frameworks and Guidelines

Have you heard of the Task Force for Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB)? If not, it is time to get familiar with them, as it is only a matter of time before these ESG reporting guidelines become mandatory in Australia. New Zealand is leading the way on this and has made it compulsory for all equity and debt issuers on the NZX3. These frameworks are designed to focus Board and executive attention on material risks and opportunities across the ESG spectrum.

By reporting in line with these frameworks, you give investors the opportunity to properly assess Board and executive performance on key ESG issues in a structured format that allows for comparison between issuers.

There are other frameworks and guidelines such as Integrated Reporting, Sustainable Development Goals and the Global Reporting Initiative which can be used in a complementary fashion to build on best practice disclosure.

Voting

Your ESG disclosures will increasingly be put to the test during voting season with proxy advisors, index funds and other institutional investors all willing to recommend or vote against directors of companies that are falling behind. They are seeking strong targets linked to the Paris Agreement and a realistic strategy for how the company will reach these goals. They want to see executive remuneration at risk for failure to execute on the ESG strategies or meet the short to medium term targets. And they want the Board to demonstrate their oversight and management of the ESG risks and opportunities to support long term, sustainable value creation.

Recommended Actions:

[1] ISS Governance, 2020 Asset Owner Stewardship Survey, 23rd Nov 2020

[2] RIAA, Responsible Investment Benchmark Report 2020 Australia

[3] New Zealand becomes first to implement mandatory TCFD reporting

About Georgeson

Georgeson, a Computershare company, is a trusted governance advisor that helps organisations across the globe maximise the value of relationships with their investors and stakeholders. By providing, strategic shareholder engagement, proxy solicitation, governance consulting and ESG advisory services, Georgeson works with issuers to de-risk the AGM process and ensure a well-informed and well-participated vote.

Let Georgeson help you secure successful outcomes at your next AGM. For a confidential conversation, please get in touch.