Public companies are increasingly engaging with investors on governance, environmental, social and other business-related topics. For companies of all sizes, shareholder engagement has extended beyond the proxy season to become a year-round strategic endeavor.

To meet investor expectations and respond to an evolving activism landscape, companies are focused on effective and sustainable shareholder engagement strategies to directly communicate important company information, highlight any corporate governance updates, offer insight into ESG developments – and, increasingly, to prepare for and respond to the threat of activist investors.

Engagement helps companies prepare for and respond to activist investors

Investor activism can take many forms. Traditional hedge fund activists may take a position in a company's stock and agitate for operational, strategic, balance sheet, governance or management changes, and perhaps to gain seats on a company's board of directors.

Non-traditional activist campaigns — including those launched by pension funds, mutual and index funds and individual investors — may often be more varied. These may include actions such as public letter writing campaigns, submission of Rule 14a-8 shareholder proposals, filing of exempt solicitation materials and voting against management proposals or one or more of a company's director candidates during the annual meeting process. Some investors will target companies on specific issues without seeking prior engagement. Longer-term index-based investors, however, will often seek to engage with a company's management and influence change constructively prior to taking a more active tact.

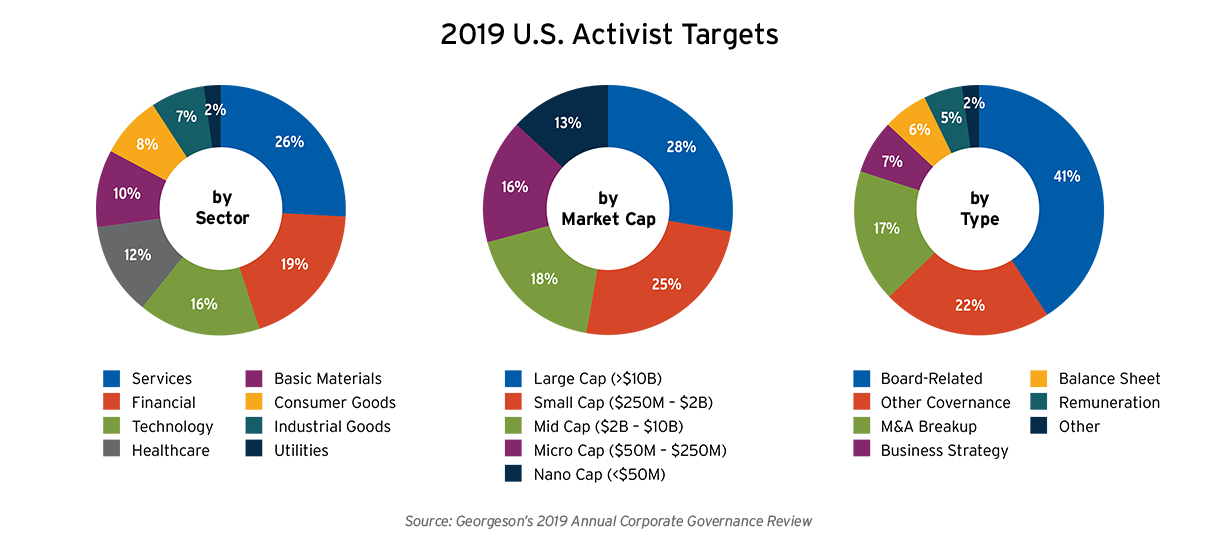

Activists' campaigns continue to evolve and take aim at companies of all industry sectors and market capitalizations. In 2019, 28% of US companies publicly subjected to activist demands were large-cap (more than $10bn), 18% were mid-cap ($2bn-$10bn), 25% were small-cap ($250mn-$2bn) and 13% were nano-cap (less than $50mn).1 These activism campaigns included balance sheet, board-related, business strategy, M&A activism, governance, remuneration and other demands.1

Just as activism takes many forms, so does engagement. Investor interactions represent a valuable opportunity to influence and educate important shareholders. In our view, engagements should be tailored for each company. They will naturally evolve as the company faces new issues and challenges and as the focus of investors shifts. And it can be challenging for companies to stay abreast of investor stewardship priorities, proxy voting guidelines and the correct contact to reach out to at each investor firm, so issuers often partner with a proxy solicitation firm to enhance and enable effective engagement programs.

Engage to prepare for activism

In 2019, Legg Mason, Campbell Soup Company, and Dollar Tree are just a few examples of listed companies that dealt with activism in some form.1

Effective institutional investor engagement programs can provide the company with a better understanding of the views and concerns of its shareholders and provide investors with a more nuanced understanding of the company's business, strategy and governance. For companies, the increased shareholder goodwill and support for management that results from effective communication can be invaluable when faced with a challenging vote or an activist situation.

Engagement is critical during fights and settlements alike

Most potential proxy fights settle before the vote because companies are under increasing pressure to do so. Activist investors may place public and private pressure on a portfolio company to settle. Whether a company settles with an activist or the campaign ends in a proxy fight, the situation will likely be costly and distracting for the company. It is important for a company to have relationships with its large institutional investors in either scenario, and to understand what information the institutions except to receive in an engagement.

Institutional investors have expressed frustration and become concerned with the trend of companies settling quickly with activists, and often conceding board seats, without seeking input from long-term investors. From a company perspective, quick settlements have some merit to the extent they help avoid significant costs and distractions, reduce public scrutiny and enable a company to extract concessions in a settlement not available in a contest. The activist may also have put forth an idea that has the support of shareholders. On the other hand, as a result of a settlement, the public perception may be that the activist has been given a "mandate" by the board that the board is acknowledging flaws in its oversight or that it is putting short-term ahead of long-term interests. There is also concern that board dynamics could be disrupted and relations with other investors may be impaired as a result of a hastily conceived and executed settlement.

Timing of engagement

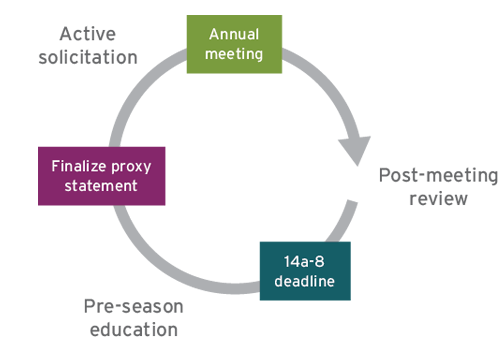

To hit the ground running during the proxy season and gain the best chances of a successful annual meeting process, off-season engagement efforts are necessary. The engagement cycle should be considered in three general phases — proxy season, pre-proxy season, and post-season review. When setting an agenda for any investor engagement there are two considerations: (1) what do management and the board want to convey to investors; and (2) what are investors likely to be concerned about?

Year-round engagement cycle with large institutional investors

- Pre-proxy season: This is when the "off season" before proxy season begins. During this period, companies can seek to engage on fundamental strategy, compensation and governance issues, including any material developments that the company faces or expects to face. Companies may leverage this engagement to gauge investors' views on various items and to address or negotiate with proponents of any 14a-8 shareholder proposals

- Proxy season: Once the proxy statement has been finalized and active solicitation has begun, engagement can help an issuer secure favorable votes. Some solicitations will be routine, however an issuer may need to engage in more strategic and targeted solicitation if it faces a challenging shareholder vote or negative recommendation from a proxy advisory firm.

- Post-meeting review: After the annual meeting is finished, engagement is a useful tool to review and understand voting results, identify changes in response to votes and discuss potential changes and collect input on those changes.

An important benefit to implementing a year-round engagement program is the issuer's ability to connect with its most influential investors during the off-season when the board, management and institutional investors have more time to dedicate to understanding and addressing issues. Investors may not have the personnel and bandwidth to give the company attention during the proxy season, (generally observed as the period between February 1 through June 30) unless there is an issue that the investor deems pressing. In addition, conducting meetings with institutional investors after the annual meeting offers issuers a unique opportunity to gather feedback on the proxy season from the institutional perspective. This "real time" feedback can help issuers clarify their messaging and positioning and understand their strengths and weaknesses. Implementing improvements based on this actionable feedback can be valuable for both the issuers and investors; these engagements can lay critical groundwork to ensure that the following proxy season goes smoothly.

Develop a successful shareholder engagement program

An effective shareholder engagement program should be customized based on a number of factors, including the company's shareholder base, industry, size and appetite for engagement. In developing a program, some useful questions to consider are:

- Which individuals within the company and board will be principally responsible for the engagement efforts?

- Which investors should be engaged?

- When and how often to engage investors?

- What channels and tactics will be used?

- Who should be included on each engagement?

- What does each specific investor care about?

Customizing each engagement outreach effort while keeping the message and position consistent and setting forth best practices to meet established goals are some of the factors that influence a successful program. Engagement efforts should also be well thought out and clearly communicated; shareholder engagement can improve investor relationships and maximize shareholder value — but may have the opposite effect if investors get the impression that an issuer was not well-prepared to discuss important issues.

In the context of activism, shareholder engagement is key to building credibility and convincing shareholders of the direction the board or management recommends. Here are some tips for successful engagements:

- Have an agenda when reaching out to your investors — don't waste their time

- Know your investors' stewardship priorities, voting guidelines and voting history

- The individuals with the voting authority within an institution may be different than the institution's analyst who covers the stock

- Tie your ESG story to the performance, value creation and compensation story

- Leverage your proxy solicitor's knowledge of investors to prepare to answer investor questions

- Consider including board representation on calls with larger investors for certain subjects

Engagement: not just for large companies

Large public companies are generally familiar with the strategic benefits of proactive, year-round engagement and many have established investor engagement programs. However, the evolving trends in shareholder activism and engagement indicate that smaller companies should consider reviewing and enhancing their engagement programs to be educated on investor issues that may relate to their business and governance structures, ensure smooth votes during proxy season and remain alert to the risk of an activist entering their stock. As we have seen, activist investors target companies of all market caps, so engagement as a preparation tool will be effective for companies of all sizes.

Institutional investors that have spearheaded governance reforms through shareholder proposal campaigns and other "private ordering" initiatives have indicated that they may push these efforts down to smaller companies. This could include engagement and proposals relating to issues such as majority voting, shareholder rights to call a special meeting, proxy access and board diversity. In addition, hedge fund activists continue to target companies of all sizes, across different industries.

Who influences proxy voting decisions?

Governance teams

Proxy advisory firms

PMs and analysts

Engagement planning tips

- Many institutions have developed teams of governance analysts who are primarily responsible for proxy voting

- Governance contacts at passive/index funds are often not the point person for the company’s IR team

- Actively managed funds and hedge funds may be more focused on strategy, economic elements may be of interest to portfolio managers

- Proxy advisory firm recommendations are not blindly followed by many institutional investors, but are used as a screen to highlight which companies they should review qualitatively

- Company should consider strategies for engaging with proxy advisory firms on key issues

Looking forward

Forward-thinking companies understand the far-reaching and long-term benefits of engaging investors throughout the year, including the ability to prepare for a potential activist situation. As activism is unlikely to decrease in the near future, the importance of shareholder engagement will continue to increase.

To effectively engage your top investors, contact us.

1. Georgeson's 2019 Annual Corporate Governance Review.

2. ISS. Executive Compensation Insights Volume 13.3.