In November of 2022, the European Parliament adopted the Corporate Sustainability Reporting Directive (CSRD), and its impacts will trickle down to US based companies in the near future. This overview report provides details on what the CSRD is, why it matters, and how it applies to US companies and their EU operations.

Use the boxes below to click through to the various sections of our report.

Key points:

- Companies will be obligated to disclose CSRD reports with sustainability information in accordance with the European Sustainability Reporting Standards (ESRS) as early as 2026 for FY2025, for EU companies not previously required by the Non-Financial Reporting Directive (NFRD).

- US parent companies operating within the EU will need to report against CSRD by 2029 on FY2028 at a consolidated level for all operations, including non-EU operations.

- Companies with EU subsidiaries or branches that are either listed or non-listed companies will be required to report depending on the scope of their operations (outlined in table 1)

- The ESRS broadens the conventional scope of sustainability reporting by necessitating companies to implement “double materiality”. This concept involves companies considering both: 1) impact materiality (how the company affects people or the environment), and 2) financial materiality.

Impact of the CSRD

What is it? An introduction to Corporate Sustainability Reporting Directive (CSRD)

The CSRD is the successor of the 2018 Non-Financial Reporting Directive (NFRD) and went into effect in 2023, requiring certain entities with business operations in the EU to publish sustainability reports in accordance with the European Sustainability Reporting Standards (ESRS). The CSRD seeks to standardize and improve the quality of corporate ESG data and disclosures, so investors and other stakeholders are provided with more comprehensive, comparable, and accessible information.

Companies with business operations in the EU have been grouped into various categories, detailed in table 1 below. The first category of companies to fall under CSRD requirements, Large Listed Companies, must report on FY2024 starting in 2025. Other categories of companies operating in the EU will be subject to different timelines as outlined further in this text.

Figure 1: Overview of the directive and standards

Companies subject to the CSRD have to report according to the European Sustainability Reporting Standards (ESRS). The ESRS builds upon the Sustainable Finance Disclosure Regulation (SFDR)1 and the EU Taxonomy2, while also incorporating concepts from the Task Force on Climate-Related Financial Disclosures (TCFD).

Why the change?

The replacement of the NFRD stems from the European Commission’s (EC) commitment to strengthen sustainability disclosures in its 2018 Sustainable Finance Action Plan. This included a review of the NFRD, which found that the non-financial reports published under the NFRD often omitted information important to investors and other stakeholders.

Therefore, the CSRD was developed to improve non-financial information/ESG data disclosure of companies to help investors and other stakeholders evaluate sustainability performance of companies.

Accordingly, the CSRD seeks to standardize and improve the quality of corporate data and disclosures, so that investors and other stakeholders are provided with more comprehensive, comparable, and accessible information. To that end, the directive also requires companies to digitally tag information to make reports machine-readable for use in the European Single Access Point (ESAP). The ESAP aims to promise investors and other stakeholders a single access point for public data and sustainability-related information on EU Companies and EU investment products. The objective is to improve the accessibility and reuse of financial sector data.

Reporting Requirements: What you should know about the EU CSRD reporting requirements

Who is impacted by the CSRD? Scope and timelines

The CSRD looks to introduce regulations to a much wider audience than its predecessor, the NFRD; the change in regulation has resulted in an additional 38,000 companies being required to comply with the CSRD, a percentage of these companies being non-EU parent companies with business operations in the EU. As such, the CSRD has a phase-in period where various companies are required to comply on different timelines depending on their categorization as outlined by the CSRD. Table 1 below summarizes this approach.

Table 1: Scope and timeline for the CSRD

| EU Company Category | Criteria for Inclusion | Timeline for Compliance |

|

Large Listed Companies (i.e. those who already report against the NFRD) |

EU listed companies who:

|

Reporting in 2025 on the 2024 FY (limited assurance required) |

|

Other Large Companies of “Public Interest” (i.e. large companies that were not previously subjected to the NFRD) |

Non-EU-listed companies who meet two of the following criteria3:

|

Reporting in 2026 on the 2025 FY (limited assurance required) |

|

Listed Small and Medium Sized Enterprises (SMEs) |

EU listed SMEs who meet two of the following criteria3:

|

Reporting in 2027 on the 2026 FY (limited assurance required) |

|

Non-EU Parent Companies (e.g., US based companies) |

Parent companies from a third country that has net turnover of more than €150 million in the EU for two consecutive financial years, and meet the following criteria:

|

Reporting in 2029 on the 2028 FY (assurance based on jurisdictional requirements of parent company not based in the EU) |

What does this mean for US companies?

The CSRD requirements cover the organization at a consolidated level, not just at the EU-based subsidiary or branch level. Therefore, US parent companies (with significant turnover in the EU) will need to publish CSRD reports that cover their entire operations, which includes operations outside the EU, by 2029 (on 2028 FY activity). These Non-EU parent companies can report using one of the following: the ESRS, standards deemed equivalent by the EC (none yet listed), or separate standards for non-EU companies (which are being developed and are expected to be adopted in June 2024).

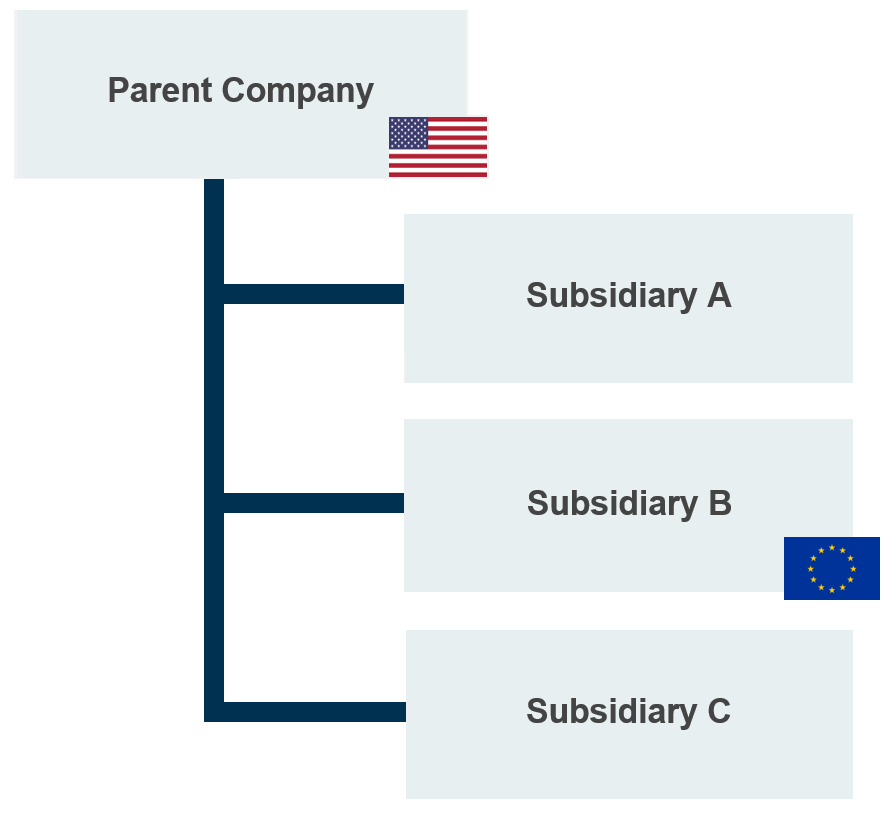

Figure 2: Illustrative example of the reporting requirements with a U.S. based parent company and their EU subsidiary.

Under the CSRD regulations, a US based company with operations in the EU will have to comply by reporting their subsidiaries’ activities (in this example, subsidiary B only).

When subsidiary B must report is based on their EU company categorization, which can be as soon as 2026. See table 1 for details.

However, a consolidated level report is expected by 2029 (based on 2028 FY activity) of the parent company.

Exceptions

The directive also establishes some exceptions:

- SMEs in transitional periods can apply for a deferral of compliance that will last until 2029 reporting on the 2028 FY.

- EU microenterprises are excluded from complying and are defined as companies who do not exceed two of the following:

- Balance Sheet total of €350,000

- Net Turnover €700,000

- Average of 10 employees during the financial year

- A subsidiary of a third country company could be exempt if the parent undertaking produces a consolidated sustainability report that conforms with the CSRD.

What is entailed? An overview of the requirements

Published Requirements

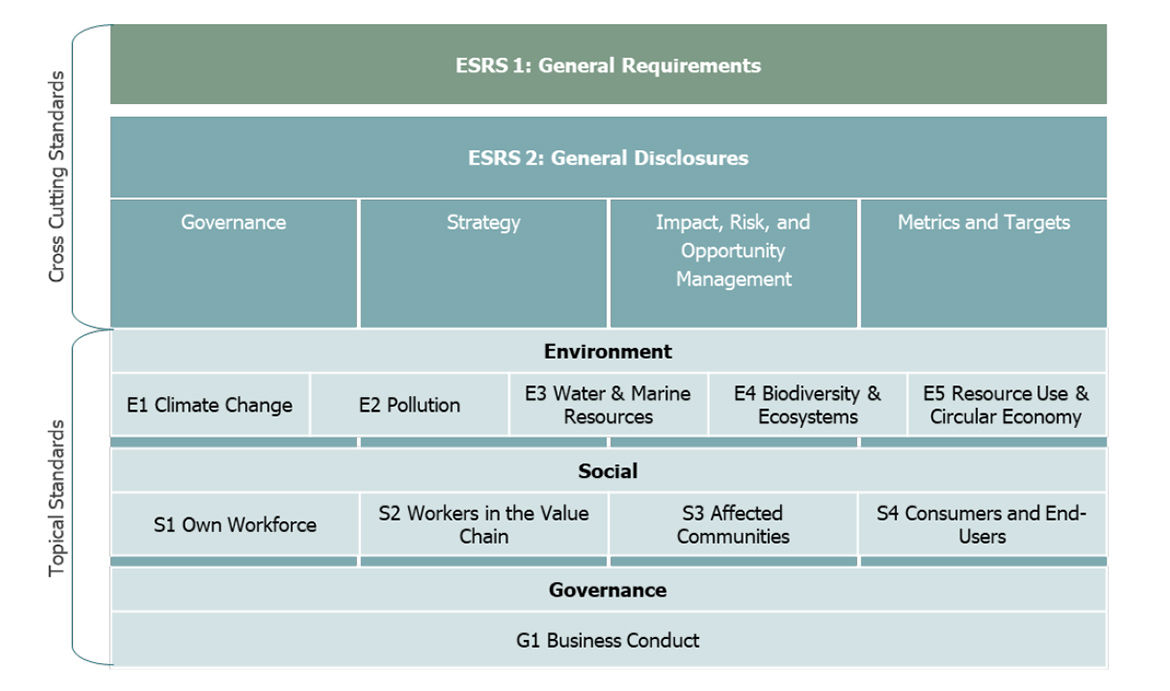

The European Financial Reporting Advisory Group (EFRAG) is the body responsible for establishing the ESRS. The current, finalized ESRS is comprised of the following:

- Two cross cutting and general requirements, ESRS 1: General Requirements and ESRS 2: General Disclosures. These two standards outline the mandatory concepts and principles to be applied.

- Ten topic specific standards that are broken down into environmental (5 topics), social (4 topics), and governance (1 topic). Disclosure against these topics is subject to the results of a materiality assessment.

Under the disclosure requirements of the ESRS, companies are required to report on the following for all material topics:

- Governance (sustainability governance and organization).

- Strategy (integrating material sustainability impacts, risks and opportunities into strategy)

- Impact, risk, and opportunity management (policies, action plans and resource allocation)

- Metrics and targets (current achievements and progress against stated targets)

Future additions: The EC is also developing separate and proportionate standards for SMEs with securities listed on regulated markets. These standards are to be created to reduce the reporting burden on these companies whilst also making it easier for them to report to banks, large-company clients, and other stakeholders. In addition, sector-specific standards are a work in progress and are proposed to help further standardize disclosures across similar companies and capture impacts, risks, and opportunities not covered or sufficiently covered under the current topical standards.

Figure 3: Overview of the ESRS

Responding to the CSRD: how others view the new directive, how it integrates, and where to start

Market reactions to the new directive

Given the impact on companies and the breadth of information required by the ESRS, investors, rating agents and proxy advisors were keen to provide their opinions on the exposure drafts from the April 29th to the August 8th, 2022. Georgeson has analyzed their statements and ascertained three overarching themes from the comment letters:

- Interoperability with the International Sustainability Standards Board (ISSB) – Investors, rating agents, and proxy advisors were eager to recommend that EFRAG could do more to align with what they consider to be the global standard for sustainability reporting that is being developed by the ISSB:

- ISS commented that “Interoperability between the EFRAG standards and the ISSB ‘global baseline’ will help to meet investor demand for decision-useful information and minimize reporting duplication and fragmentation.”

- BlackRock noted that “the extraterritorial scope of CSRD increases the risk of conflicts with the legal frameworks of other jurisdictions”.

- Norges Bank Investment Management (NBIM) “are aware of and welcome the ongoing dialogue between EFRAG and the ISSB towards the inter-operability of their standards” and stated that “this will help reduce the reporting burden for companies and ensure the comparability of disclosures for users.”

- Initial standards were complex, presented a reporting burden and potentially required a phased approach – Many had an issue with the initial sector-agnostic standards which would mean that companies would have to report information for several sustainability matters regardless of their materiality to the company. This was seen by commentors as too much of a reporting burden and some raised the point that the metrics being suggested were not widely used or standardized:

- DWS commented that “it is highly likely that the overall high number of ESRS documents and disclosure requirements will increase the reporting burden”.

- The PRI commented on the potential for unintended consequences, for example “a lack of corporate readiness may impact the quality and comparability of disclosures”.

- NBIM noted that due to this complexity “some aspects of the standards may be better suited as ‘comply or explain’ rather than requirements”.

- Bloomberg noted that the ESRS will place a significant burden on companies as it contains a significant number of key performance indicators (KPIs) on ESG aspects that are “almost never” reported on by companies.

- Approach to materiality should be applied – Some disagreed with the initial materiality approach adopted by the ESRS. Specifically, sector-agnostic standards where companies would have to report on topics regardless of the materiality assessment. After the consultation period, sector-agnostic standards were removed in favor of topical standards, which are subjected to a double materiality assessment for inclusion:

- Allianz argued that “sustainability reporting should be subject to materiality considerations at all times, without requiring companies to publicly rebut materiality or disclose immateriality evidence, which would by nature be immaterial”.

- However, Eumedion supported the rebuttable presumption but noted that to avoid ‘information overload’ the revised ESRS drafts should provide “clearer guidance to reporting entities on the criteria for the rebuttable presumption”.

- MSCI was of the same opinion as Eumedion, claiming that the “ESRS should remove the scope for subjectivity in double materiality assessments by providing clearer application guidance for undertakings on what needs to be included or excluded.”

How the CSRD integrates with other existing frameworks

Depending on the framework, there will be differing levels of effort required to meet the directive.

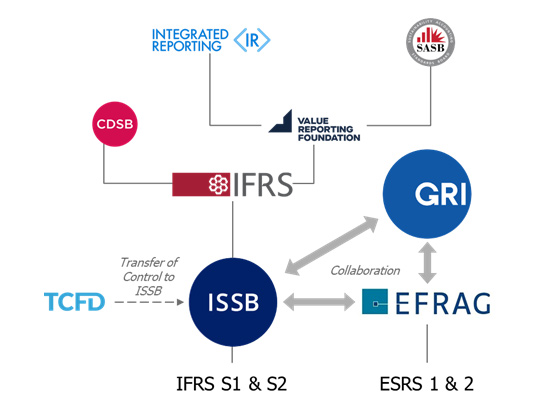

TCFD and GRI

The most transferable frameworks are the Task Force on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) due to both being used to inform the development of the ESRS. The CSRD changed their original draft of the ESRS to follow the TCFD pillars (governance, strategy, risk management, and metrics and targets), except for risk management being changed within the ESRS to “impact, risk and opportunity management”. As for the GRI, both it and the CSRD share the same materiality perspective, which requires companies to disclose on topics based off materiality assessments.

EFRAG has also published a document on comparing the TCFD with the ESRS. On the other hand, the GRI and EFRAG has an existing memorandum of understanding, increasing the interoperability of the two, and therefore official guidance from the GRI and how to use their reporting practices and processes to meet the ESRS will be published once the final standards are enacted.

CSRD and upcoming frameworks

SEC Climate Ruling

There are no conflicts between the ESRS and the U.S. Securities and Exchange Commission’s (SEC) climate ruling (expected to come out in late 2023). Under the proposed climate rule, companies will have to take a financial lens to determine material risks posed by climate change to their business and report accordingly. In contrast, the ESRS will require double materiality (resulting in a broader scope comparatively), comprising of other environmental topics as well as social and governance related disclosures. Therefore, under the proposed SEC ruling, meeting the SEC requirements will most likely not be sufficient to meet the CSRD requirements.

ISSB

The ISSB has released its inaugural International Financial Reporting Standards (IFRS) for sustainability reporting, a two-part standard titled IFRS S1 and S2. These standards are intended to be the de facto standards that have an investor focus. Therefore, the ISSB standards are inherently different from the ESRS as they cater to different stakeholders. Companies should consider the IFRS and how it relates to both their current reporting practices and the new upcoming ESRS (if they have EU operations). Toward that end, EFRAG has released guidance on how the ESRS compares with the IFRS.

Figure 4: Overview of the development of global sustainability reporting frameworks and their relations to each other.

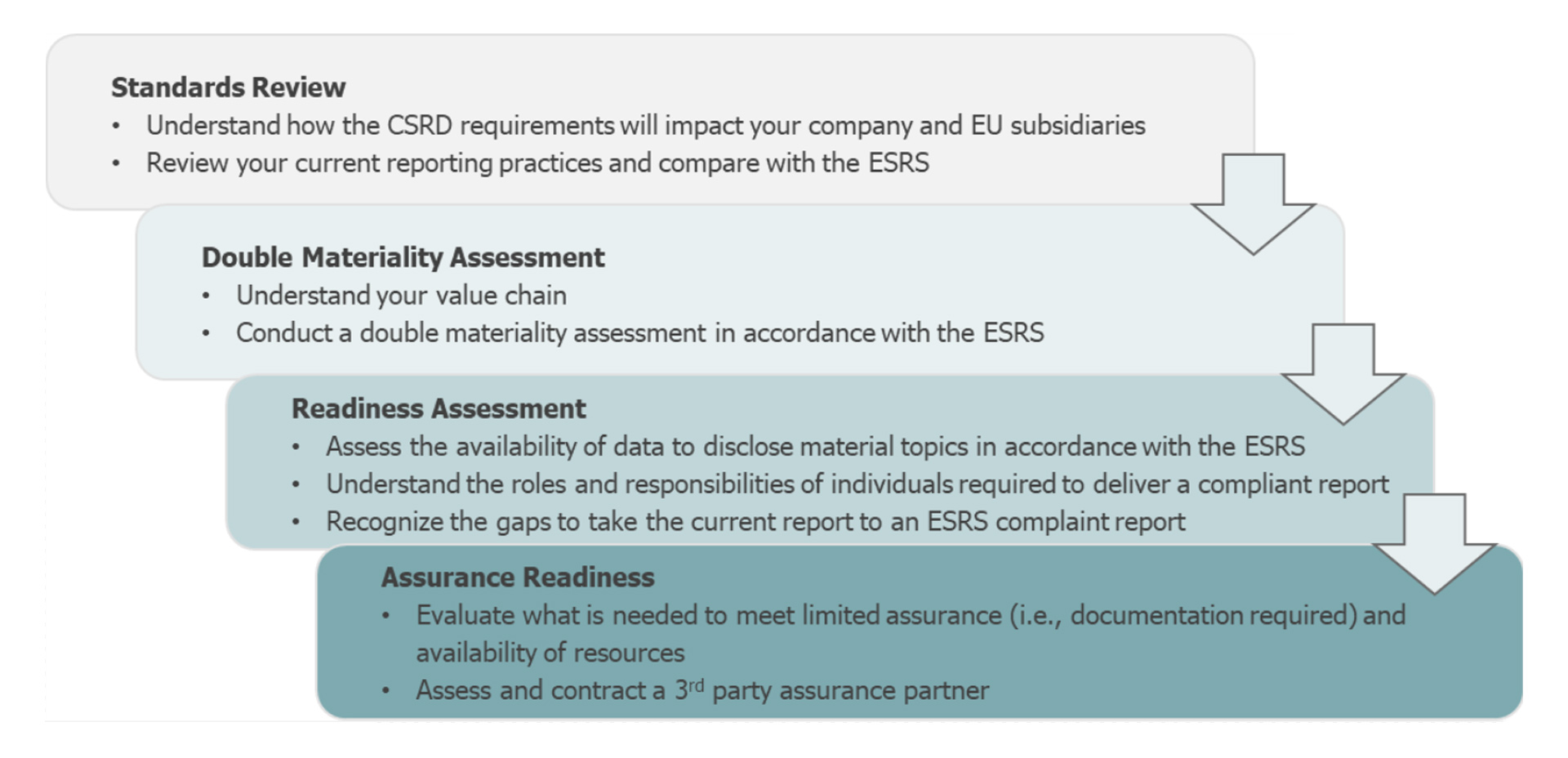

What actions you can consider now

U.S. parent companies and their subsidiaries will need to take account of their existing practices and capabilities in preparation for the upcoming regulation. Senior management should expect to revisit their strategic focus and bring greater systematic and global approach to corporate sustainability. Without an existing robust sustainability practice, new systems and procedures will have to be put in place to measure and monitor progress as prescribed by the directive and in order to collect the vast quantity of data that will be required disclosure. Companies should start planning their approach at the earliest convenience.

Steps for corporates

This notice is provided by Georgeson for general informational purposes only and is not intended and should not be construed as legal, regulatory, financial or tax advice. Georgeson is not licensed or authorized to practice law in any jurisdictions and hence does not provide any legal advice and it does not hold itself out as doing so. Neither Georgeson nor any of its affiliates or contributors accept any responsibility or liability for the quality, accuracy or completeness of any information contained in this notice. It is important that you seek independent professional advice relating to the subject matter of this notice before relying on it.

Georgeson is the world’s foremost provider of strategic shareholder consulting services to corporations and shareholder groups working to influence corporate strategy. We offer unsurpassed advice and representation in annual meetings, mergers and acquisitions, proxy contests and other extraordinary transactions. In global transactions, our capacity and network are unmatched. Our core proxy expertise is enhanced with and complemented by our corporate governance consulting and asset reunification services.

For more information, visit www.georgeson.com or call 212 440 9800.

1 The SFDR is a European regulation that focuses on the increased disclosure of ESG related information at an entity and product level for financial market participants and financial market providers.

2 The EU Taxonomy is a framework for classifying “green” or “sustainable” or “environmentally friendly” economic activities within the EU. The purpose of the taxonomy is to prevent greenwashing within the financial markets.

3 The EU has passed a directive that has updated the threshold definitions for large and SME undertakings (Delegated directive – C(2023)7020) to account for inflation since the original definitions were from 2013. The revised memo here reflects those changes.

4 Net turnover is generally defined as “the amounts derived from the sale of products and the provision of services after deducting sales rebates and value added tax and other taxes directly linked to turnover”. For a more detailed definition, please refer to the directive itself.

5 The updated definitions for undertakings (see footnote 3) have not been stated to change the threshold requirement for a branch. Using a conservative approach, companies should still expect that the threshold remains unchanged at €40 million until otherwise.