In April 2019, the Teachers Insurance and Annuity Association of America (TIAA) and Nuveen published the 7th edition of their Policy Statement on Responsible Investing ("the Policy Statement")1. The document contains three unique sections; updated voting guidelines, a discussion of the firm's views on environmental, social and governance (ESG) issues, and a section focused on its responsible investing team.2

The Policy Statement applies to all funds within the TIAA-CREF Funds complex.

Updated proxy voting guidelines

| We monitor [our] portfolio companies' environmental, social and governance (ESG) practices to ensure that boards consider these factors in the context of their strategic deliberations. |

|---|

TIAA's 7th edition Policy Statement details the firm's updated proxy voting guidelines, which have not been substantially updated since the 6th edition.3 The guidelines conclude that "a one-size-fits-all approach" to voting is not practical. The guidelines take into account a number of key financial and ESG considerations.

TIAA's voting guidelines are divided into two distinct proxy voting categories:

A. Accountability & transparency

B. Guidelines for ESG shareholder proposals

A. Accountability & transparency

This section covers the following three major corporate governance topics:

- Board of directors

- Shareholder rights

- Compensation issues

Board of directors

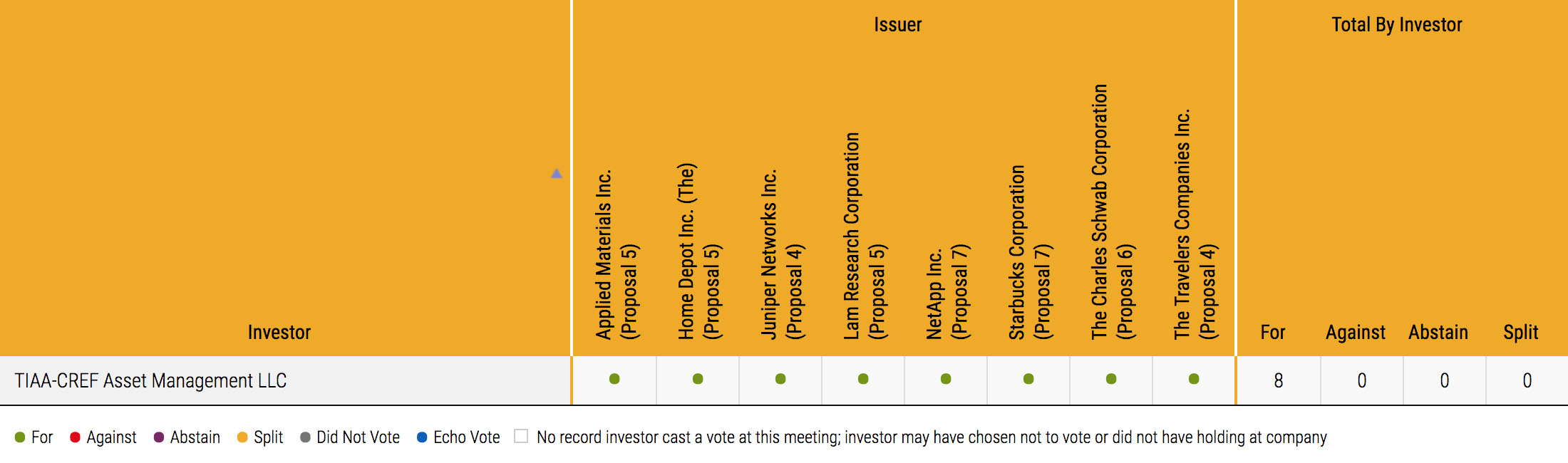

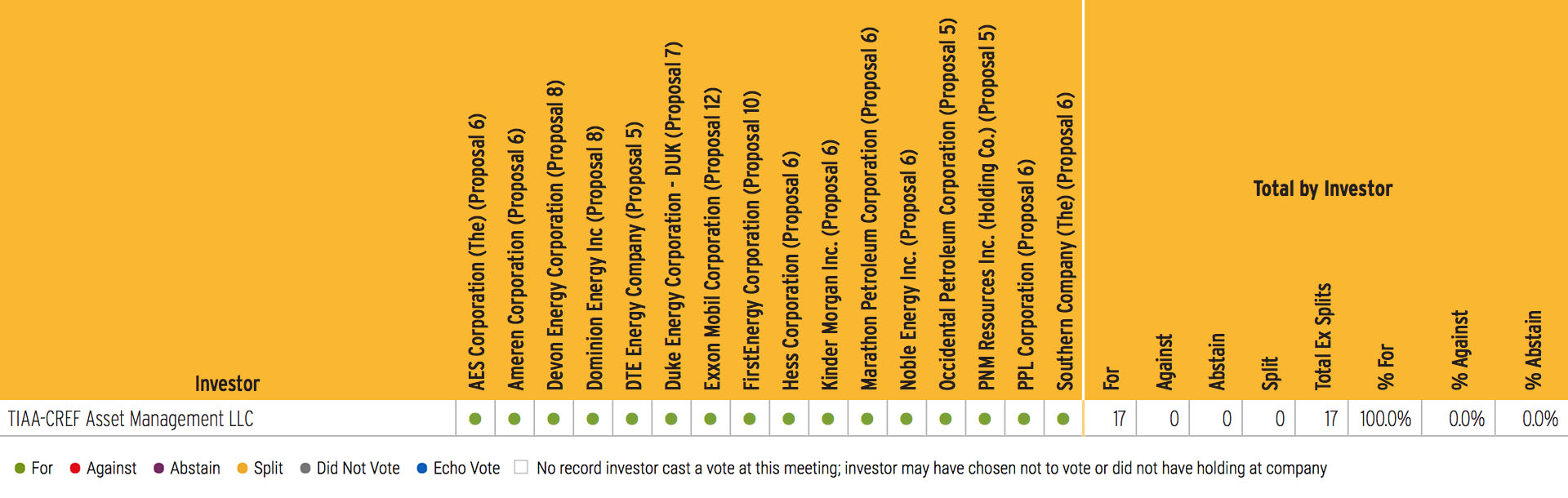

Historically, TIAA has generally supported director nominees in elections, as showcased in the data below.4

In their Policy Statement, TIAA provides examples of circumstances where it would not support a director's election on the management slate, based on actions undertaken by the individual or the board. The actions that would prompt TIAA to vote against a director include issues such as:

- Egregious compensation practices

- Lack of responsiveness to a failed vote

- Board independence not in line with market best practices

- Conflict of interest

- Insufficient diversity

TIAA does not provide great detail around these circumstances, and therefore many of their voting policies on director elections is open to interpretation when applied to a specific company.

With respect to board-related shareholder proposals, the Policy provides that TIAA will support shareholder proposals related to establishing a majority vote standard or declassifying the board. Notably, it states that the fund generally will not support a shareholder proposal separating the Chairman and CEO roles; however, if TIAA believes there is not a lead independent director with robust responsibilities and it finds the company's ESG practices and business practices are deficient, they would consider supporting a shareholder resolution to separate the roles.

Shareholder Rights

TIAA states that it will continue to support shareholder proposals on proxy access on a case-by-case basis, taking into account a number of company factors when making their voting decision.

We've summarized their voting policies on shareholder rights-related shareholder proposals by topic in the boxes below:

Key:

- Green – TIAA will "generally support"

- Yellow – TIAA will consider on a "case-by-case basis"

- Red – TIAA will "generally not support"

*Supportive of 25% ownership threshold

Finally, consistent with its prior policy statement, TIAA noted in this 7th edition Policy Statement that it generally would not support a shareholder proposal that promotes a political agenda that is contrary to the mission of TIAA.

Other shareholder rights topics covered in this section include their voting policies on the following topics:

- Ratification of auditors – TIAA generally will support the board's choice of auditor, but may consider voting against the auditor if there has been a material restatement of financials by the company

- Anti-takeover devices – TIAA will consider proposals on a case-by-case basis

- Reincorporation – TIAA will consider proposals on a case-by-case basis

Compensation Issues

Say-on-pay

Consistent with its prior policy, TIAA states that it will generally consider say-on-pay votes on a case-by-case basis and provides a substantive list of 'red flags' it notes when evaluating executive compensation plans:

- Undisclosed or inadequate performance metrics

- Excessive equity grants

- Lack of minimum vesting requirements

- Misalignment of interests between executive pay structures and shareholders

- Special award grants

- Excess discretion in respect of compensation committee decision-making

- Lack of clawback policy

Equity-based compensation

TIAA's Policy Statement provides that it will generally consider equity-based compensation plan votes on a case-by-case basis and identifies the following substantive list of 'red flags' they note when evaluating equity plans:

- Evergreen features

- Reload options

- Repricing options

- Undisclosed or inappropriate option pricing

Finally, TIAA discloses they will vote on a case-by-case basis on golden parachute proposals.

B. Guidelines for ESG shareholder proposals

| We generally support shareholder resolutions seeking reasonable disclosure of the environmental and social impact of a company's policies, operations or products. |

|---|

TIAA states it will "generally support shareholder resolutions seeking reasonable disclosure of the environmental or social impact of a company's policies, operations or products."

New to the 7th edition Policy Statement, TIAA has categorized ESG shareholder proposals into four major issues, listed below.

| Environmental issues |

Issues related

to customers |

Issues related to

employees and suppliers |

Issues related

to communities |

|---|

The boxes below summarize specific ESG shareholder proposals, by topic, that the TIAA Policy Statement stated it would "generally support."

| Disclosure on global climate change | Disclosure on use of natural resources | Disclosure on company's environmental impact | Report on company's impact on animal welfare | Disclosure on safety of company's goods and services |

| Disclosure of lending activities | Disclosure on nondiscrimination policies | Review of compay's labor standards | Disclosure on public health impact | Review of company's human rights policies |

A review of TIAA's voting in 2017 and 2018 demonstrates that its policy guidance is consistent with its voting practices.

The tables below detail TIAA's voting history on two recent shareholder proposal categories, voted on at annual meetings for companies in the S&P 1500 index.

2018 Shareholder Proposal Voting History: Select Employment Diversity Shareholder Proposals5

2017 Shareholder Proposal Proxy Voting History: Select Climate Change Proposals

While TIAA's voting policies on key ESG shareholder proposal topics remain largely unchanged, throughout the Policy Statement it is apparent the fund has expanded its focus on these issues.

| As investors, we believe that issuers should demonstrate that they have carefully considered the strategic implication of relevant environmental, social and governance (ESG) issues on long-term performance. |

|---|

TIAA states it believes companies should "apply a broader stakeholder lens" when they are analyzing their key decisions, to take into account issues like the environment, customers, employees, and impact in communities in which their portfolio companies operate. TIAA makes recommendations for boards and companies to consider regarding key ESG matters relating to the following:

A. Business ethics, transparency and accountability

B. Environment

C. Customers

D. Employees and suppliers

E. Communities

Notable recommended actions for boards and companies include the following:

Overall, TIAA's views on these key ESG issues suggests that it believes a board's fiduciary duty should extend beyond financial decisions to take into consideration these extra-financial decisions/ factors that TIAA sees as key to driving long-term value.

TIAA further states that it supports measures that mitigate the risks associated with climate change and outline climate change risks on a basis consistent with the Task Force on Climate Related Financial Disclosure (TCFD).6

Founding of responsible investing program

TIAA's strategic investment focuses have evolved considerably in the past eight years. Consequently, TIAA has established a responsible investing ("RI") team to spearhead "efforts to systematically integrate material ESG and sustainability factors into the investment decision process."

TIAA has implemented their RI investing commitment through activities using a set of core principles. These core principles include the following three firm-wide activities:

- Engagement: TIAA stresses the importance of engagement with companies. By prioritizing transparency they strive to "fulfill the existing information gap that can otherwise hinder rigorous investment analysis."

- ESG integration: Throughout TIAA's Policy Statement, the firm promotes its interest in disclosure of ESG information, which it believes "provides an additional lens to use when assessing company and issuer performance." As a core principle of its RI program, TIAA's ESG integration focuses on recognizing the financial relevance of material ESG themes and facilitating access to ESG information.

Impact: The final core principle of TIAA's RI program focuses on the investor's belief that "all investments have impact on society and the environment."

| We seek to implement a set of principles that support well-functioning markets in order to preserve financial, social and environmental capital. |

|---|

Conclusion

TIAA's Policy Statement provides clear insight into its evolving interests and greater focus in leveraging its RI program to encourage companies to focus additional attention and provide disclosure on ESG issues.

It is Georgeson's advice that TIAA's portfolio companies become familiar with the information presented in our report and further reference the Policy Statement online to understand better TIAA, its investment focus and voting policies.

Link to 7th edition (2019) here: https://www.tiaa.org/public/pdf/ri_policy.pdf

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.

1This document was published by Nuveen, the asset-management arm of TIAA. Nuveen oversees TIAA's proxy voting.

2Nuveen manages the Responsible Investment team.

3TIAA 6th edition (2011) here: https://www.tiaa.org/public/pdf/pubs/pdf/governance_policy.pdf.

4Russell 3000 Data provided by Georgeson's 2018 Annual Corporate Governance Review, in partnership with Proxy Insight Ltd. https://www.georgeson.com/us/news-insights/annual-corporate-governance-review.

5Data provided by Georgeson's 2018 Annual Corporate Governance Review, in partnership with Proxy Insight Ltd.

6TCFD was established in 2015. It has created voluntary climate-related financial risk disclosures for use by companies in providing information to "investors, lenders, insurers, and other stakeholders." TCFD provides guidance to assist companies in formulating these disclosures. https://www.fsb-tcfd.org/about/#.