Introduction

Glass Lewis released the first of its updated benchmark voting policies for 2026 for the UK and Continental Europe on 4 December 2025. It subsequently released the voting policies for individual major European markets including Belgium, France, Germany, Ireland, Italy, the Netherlands, Spain, and Switzerland. The new benchmark policies will be effective from January 2026.

This memo summarises the policy changes for updates applicable to the UK and Continental Europe, in addition to market-specific updates. Accordingly, it consists of a chapter on updates applicable across both regions, followed by specific sections for changes relevant only to the UK, to Continental Europe, and to individual continental European countries.

Executive Summary

A negative recommendation from Glass Lewis often has an adverse impact on the vote outcome of a given resolution. These updates could lead Glass Lewis to make a negative voting recommendation on a resolution due to a factor that was not previously considered. We recommend evaluating how these changes could impact your upcoming shareholders’ meetings, and we are available to assist you with any questions that you may have. The below table provides a summary of the major policy updates:

| Policy | Updates |

| UK and Continental Europe | Apply a new proprietary pay-for-performance model across issuers in the UK and Continental Europe. Voting recommendations will not be based solely on the output of this model. |

| UK | More stringent expectations and voting recommendations on Board Committee size, Board Gender Diversity and the Independence of Boards at AIM companies. |

| Ireland | Various updates given the newly published Irish Corporate Governance Code, specifically regarding independence and board responsiveness, and the Companies Act 2024 with respect to virtual-only shareholder meetings. |

| Continental Europe | Glass Lewis will now analyse the auditor’s opinion for non-financial report resolutions and will scrutinize the inclusion of qualitative and/or non-financial metrics as performance metrics for pay. |

| France | Recognises the transposition of the “Women on Boards” directive and the AFEP-MEDEF code on the review of an executive’s fixed compensation by the compensation committee. |

| Germany | Glass Lewis have included more detailed expectations for German companies addressing shareholder dissent for authorities to hold virtual-only shareholder meetings from the previous AGM. |

| Italy | Clarified disclosure formats for companies to report five‑year development of CEO pay and average employee pay. |

| Spain | No market-specific developments. |

| Netherlands | Wording on Committee Independence has been updated to more closely align with the Dutch Corporate Governance Code. |

| Switzerland | No market-specific developments. |

| Belgium | Policy now reflects the disclosure requirements set by the Belgian Code of Companies and Associations for remuneration reports and clarifies that independent directors may not receive variable remuneration. |

Changes that apply across the UK and Continental Europe

Pay-for-Performance new model (New)

Glass Lewis will apply a new proprietary pay-for-performance model as its primary quantitative tool to assess the alignment between executive remuneration and company performance, utilising an independently selected peer group1 of companies that may differ from the company’s own disclosed peers. The model uses a scorecard approach by (i) conducting five tests, (ii) calculating a severity rating for each of these tests, and (ii) producing an overall alignment score ranging from 0 to 100. The tests that Glass Lewis will conduct are:

- Total vested CEO pay vs. Total Shareholder Return (TSR);

- Total vested CEO pay vs. financial performance;

- CEO STI payouts (in relation to maximum opportunity) vs. TSR;

- CEO LTI payouts (in relation to maximum opportunity) vs. TSR;

- An alternative test comparing total vested CEO pay vs. company size measures as multiple of median;

- A qualitative downward modifier.

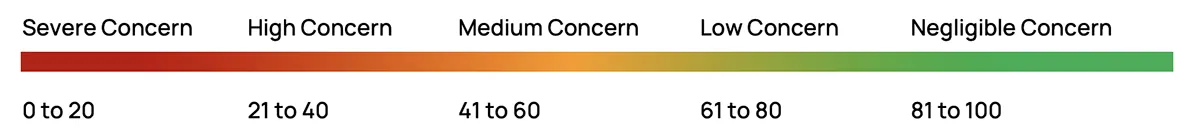

The final score determines the corresponding level of concern:

In addition, Glass Lewis may include specific comparisons of executive pay and performance relative to peers in its analysis for further insights. Companies scoring “Severe Concern” or “High Concern” will more likely face a negative recommendation. However, recommendations will not be based solely on the score as Glass Lewis will consider additional qualitative factors including, but not limited to (i) the consideration of competitors based in other regions and excluded from the peer group, (ii) overall incentive structure, (iii) trajectory of the programme and disclosed future changes, (iv) the operational, economic and business context, (v) reasonable payout levels, or (vi) the presence of a compelling rationale explaining any deviation from best practice.

Changes that apply in the UK & Ireland

UK

Board Committee Size (New)

Glass Lewis has updated the Benchmark Policy to reflect that, where a committee is of insufficient size, the Benchmark Policy will typically recommend that shareholders vote against the re-election of the audit and/or remuneration committee chair, rather than abstain from voting.

Board Gender Diversity (New)

In line with the FTSE Women Leaders Review, Glass Lewis has set a new threshold for gender diversity at board level: the Benchmark Policy will generally recommend against the re-election of the nomination committee chair at FTSE 350 companies where the board does not comprise at least 40% gender diverse directors, absent any mitigating circumstances.

AIM Companies’ Board Independence (New)

The proxy advisor has reviewed the guidelines on board independence for AIM-Quoted companies to align them with the 2023 QCA Corporate Governance Code. As such, AIM companies' boards should be at least half independent and include a minimum of two independent non-executive directors. If more than half of the members are considered affiliated or inside directors, Glass Lewis will recommend against one or more of the non-independent directors.

Key Committees (Clarification)

The Benchmark Policy has been updated to clarify that, for the purposes of director attendance, the key committees generally considered are the audit, remuneration and nomination committees.

Remuneration Committee Independence (Clarification)

The guidelines on remuneration committee independence have been updated to clarify that the board chair may serve as a member – but not chair – of the remuneration committee, if they were independent upon appointment and continue to be in the following years.

Vesting/Holding Periods (Clarification)

The section on remuneration policies has been updated to clarify that long-term incentives should provide for a combined vesting and holding period of at least five years and a minimum three-year vesting/performance period, as outlined in the UK Code and by the Investment Association.

Ireland

Irish Corporate Governance Code (New)

Glass Lewis has updated its Benchmark Policy guidelines to reflect the introduction of the Irish Corporate Governance Code. References will now be made to the principles and provisions of the Irish Code, rather than the UK Code, where applicable.

Euronext Growth Dublin (EGD)/AIM Companies’ Independence (New)

In line with the 2023 QCA Corporate Governance Code, the Benchmark Policy has clarified expectations regarding board independence at EGD and AIM companies. As such, boards should be at least half independent and include a minimum of two independent non-executive directors. If more than half of the members are considered affiliated or inside directors, Glass Lewis will recommend against one or more of the non-independent directors.

Board Responsiveness (New)

The Benchmark Policy has been amended to outline its approach to board responsiveness in the context of significant shareholder dissent. While consistent with the UK Benchmark Guidelines, the Policy will take into account the higher dissent threshold set by the Irish Code (25%) when assessing the adequacy of disclosure in response to shareholder concerns.

Virtual-only Shareholder Meetings (New)

The Benchmark Policy has been updated to reflect the impact of the Companies (Corporate Governance, Enforcement and Regulatory Provisions) Act 2024 on the regulatory framework governing virtual-only and hybrid shareholder meetings.

Updates on the Continental Europe guidelines

Non-Financial Reporting (New)

Multiple sections of the guidelines have been amended to specify that if the auditor refuses to provide an opinion, provides a qualified or provides an adverse opinion on a company’s

non-financial reporting, Glass Lewis may recommend against the approval of accounts and reports or non-financial reporting.

Non-Financial Metrics (New)

Glass Lewis has stated that it may recommend against remuneration-related proposals if a performance metric is largely reliant on qualitative and/or non-financial metrics with no financial underpins or gateways.

Shareholder Meeting Format (Clarification)

The Benchmark Policy’s discussion on shareholder meeting formats has been expanded to clarify that companies should provide a clear and sufficient rationale for holding a meeting without in-person attendance when the board has legitimate concerns about convening an in-person meeting and/or has received relevant guidance from local authorities.

Board Responsiveness (Clarification)

Glass Lewis has clarified that, when evaluating the level of unaffiliated shareholder dissent expressed at a previous meeting, the company’s ownership structure and the meeting quorum are taken into consideration.

Sign-On Awards (Clarification)

Glass Lewis has updated the list of factors that may lead to a negative recommendation on remuneration-related items to explicitly include egregious or excessive sign-on awards. The policy also reports the difference between those and ‘replacement awards’, as sign-on awards relate to extraordinary remuneration granted to an individual upon their appointment that does not correspond to remuneration forfeited upon departure from the individual’s previous role.

Additional updates to specific continental European markets

France

Board and Executive Gender Diversity (New)

Glass Lewis has updated the Benchmark Policy to reflect the transposition of the EU’s “Women on Boards” directive, which specifies that employee shareholder representatives will count toward board gender diversity requirements and mandate at least 40% representation of each gender for companies with certain characteristics. The policy also notes that supervisory boards in two-tier structures must set quantitative objectives for improving gender balance on management boards, with compliance required upon the next board renewal or member replacement. If companies are not compliant with such requirements, the Benchmark Policy may recommend that shareholders vote against the re-election of the governance committee chair (or equivalent). Both changes will be applicable from June 30, 2026 in line with the transposition of the “Women on Boards” directive.

Fixed Compensation (New)

The guidelines were updated in line with the AFEP-MEDEF code and the AFG recommendations to specify that the executives’ fixed compensation is not expected to be reviewed by the compensation committee on a frequent basis, unless a compelling rationale is provided.

Severance Agreements and Payments (Clarification)

Glass Lewis has updated its guidelines to provide greater clarity on severance arrangements between executives and companies, and the related payments. In line with the AFEP-MEDEF Code, the Benchmark Policy may recommend voting against the remuneration of a departing executive where severance entitlements under an employment contract are not adequately disclosed. Further, in line with the AFEP-MEDEF and the Middlenext Codes, the Benchmark Policy may recommend against the remuneration of an executive leaving their corporate office role in case they are awarded a severance even if they are maintaining a role within the company or are retiring.

Germany

Shareholder Meeting Format (Clarification)

Glass Lewis has expanded its guidelines to clarify that, consistent with the Benchmark Policy approach to board responsiveness, companies are expected to address material shareholder dissent relating to authorities to hold virtual-only shareholder meetings from the previous AGM. The Benchmark Policy’s analysis of such authorities will consider, among other factors, the manner in which the company has conducted shareholder meetings since 2022, any disclosed commitment to hold one or more in‑person or hybrid meetings during the authorisation period, and whether the management board’s decision on meeting format is subject to supervisory board approval.

Italy

CEO Pay Ratio (Clarification)

Glass Lewis has clarified its expectations regarding the disclosure formats used by Italian companies to report the five‑year development of CEO pay and average employee pay, as required under SRD II. The Benchmark Policy considers disclosure in the form of ratios or monetary amounts to be more meaningful than year‑on‑year percentage changes, together with disclosure of total CEO pay for the year under review.

Spain

All changes applicable in Spain are covered in the Continental European section.

Netherlands

Committee Independence (New)

Committee independence has been updated to align more closely with the Dutch Corporate Governance Code, clarifying that more than half of committee members should be independent and refining language related to audit and remuneration committee chairs.

Switzerland

All changes applicable in Switzerland are covered in the Continental European section.

Belgium

Vote on Executive Remuneration (Say-on-Pay) (New)

The 2026 policy now reflects the disclosure requirements set by the Belgian Code of Companies and Associations for remuneration reports regarding the disclosure of remuneration over at least five fiscal years and ratio of the highest executive pay and the lowest employee pay.

Incentive Plans for Board Members (Clarification)

Glass Lewis has revised the guidelines on incentive plans for directors to clarify that independent directors may not receive any variable remuneration, as set by the Belgian Law. It also clarifies that non-executive board members should not receive performance-based pay, while confirming that a portion of fixed remuneration may be granted in restricted shares.

1Peer groups for companies based in Continental Europe or in the UK are drawn from blue-chip and mid-cap firms across major European markets and the UK, using size-based ranking and screening.

Disclaimer: While all information in this report/analysis has been obtained from sources considered to be reliable, Georgeson and its employees do not warrant the complete accuracy of the information. Save for statutory liability which cannot be excluded, Georgeson further disclaim all responsibility for any loss or damage which may be suffered by any person relying upon such information.

For more information please contact:

Daniele Vitale

Head of ESG, UK & Europe

daniele.vitale@georgeson.com-

Daniel Veazey

Corporate Governance Manager

daniel.veazey@georgeson.com

Claudia Morante Belgrano

Head of Corporate Governance, Spain

c.morante@georgeson.com

Francesco Surace

Head of Corporate Governance, Italy

francesco.surace@georgeson.com