Having the correct format of names on unclaimed property reports is crucial for the state to determine the rightful owner(s) of the property. This is especially important when reporting property with specific ownership relationships such as beneficiaries, custodians, trustees, etc.

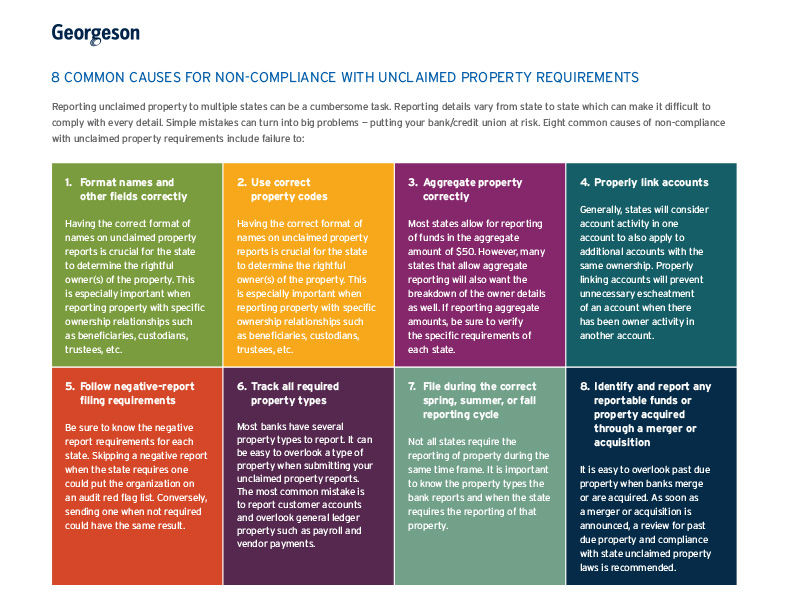

Reporting unclaimed property to multiple states can be a cumbersome task. Reporting details vary from state to state which can make it difficult to comply with every detail. Simple mistakes can turn into big problems — putting your bank/credit union at risk. Eight common causes of non-compliance with unclaimed property requirements include failure to:

1. Format names and other fields correctly

2. Use correct property codes

Having the correct format of names on unclaimed property reports is crucial for the state to determine the rightful owner(s) of the property. This is especially important when reporting property with specific ownership relationships such as beneficiaries, custodians, trustees, etc.

3. Aggregate property correctly

Most states allow for reporting of funds in the aggregate amount of $50. However, many states that allow aggregate reporting will also want the breakdown of the owner details as well. If reporting aggregate amounts, be sure to verify the specific requirements of each state.

4. Properly link accounts

Generally, states will consider account activity in one account to also apply to additional accounts with the same ownership. Properly linking accounts will prevent unnecessary escheatment of an account when there has been owner activity in another account.

5. Follow negative-report filing requirements

Be sure to know the negative report requirements for each state. Skipping a negative report when the state requires one could put the organization on an audit red flag list. Conversely, sending one when not required could have the same result.

6. Track all required property types

Most banks have several property types to report. It can be easy to overlook a type of property when submitting your unclaimed property reports. The most common mistake is to report customer accounts and overlook general ledger property such as payroll and vendor payments.

7. File during the correct spring, summer, or fall reporting cycle

Not all states require the reporting of property during the same time frame. It is important to know the property types the bank reports and when the state requires the reporting of that property.

8. Identify and report any reportable funds or property acquired through a merger or acquisition

It is easy to overlook past due property when banks merge or are acquired. As soon as a merger or acquisition is announced, a review for past due property and compliance with state unclaimed property laws is recommended.

The costs of non-compliance

Apart from the loss of assets turned over to the state, the escheatment process itself creates significant expenditures for holders. The cost of compliance may include an external vendor and/or employee hours consumed in tracking and complying with all state laws. However, the cost of non-compliance can be even greater. To ensure compliance, states will perform audits or hire third-party contingent fee auditors. Many of these audits can extend over multiple years, costing the holder significant intangible losses such as extra personnel needed to review and fulfill auditor’s requests. This is time taken away from normal job duties simply to satisfy an audit request.

States will also charge holders tangible fees in the form of penalties and interest when compliance has not been satisfied. For example, California charges 12% interest on past due property for every year it does not get reported to the state. Holders can also incur additional costs by hiring external legal expertise and staff to assist with defending the audit findings. Lastly, and often the highest cost, is the reputational loss a company might face when their name appears negatively in the press.

Ready to learn more?

From owner location programs to support with audits, Georgeson’s multidisiplinary team offers tailored services that cover the unclaimed property lifecycle. Discover how Georgeson can help your bank/credit union manage your unclaimed property processes — we take the worry out out of unclaimed property so you can focus on your core business.