NEW YORK — There has been a record-breaking volume of shareholder proposal submissions on environmental, social and governance (ESG) issues at the annual meetings of Russell 3000 companies so far this year, according to Georgeson. In its 2022 Early Proxy Season Review, the strategic shareholder services provider shows that shareholders submitted 924 ESG shareholder proposals at Russell 3000 companies between July 1, 2021 and May 16, 2022, compared to 837 during the 2021 season and 754 in 2020.

However, the report also demonstrates that shareholder support for the 137 proposals specifically relating to environmental and social (E&S) issues voted upon so far this year has been more muted.

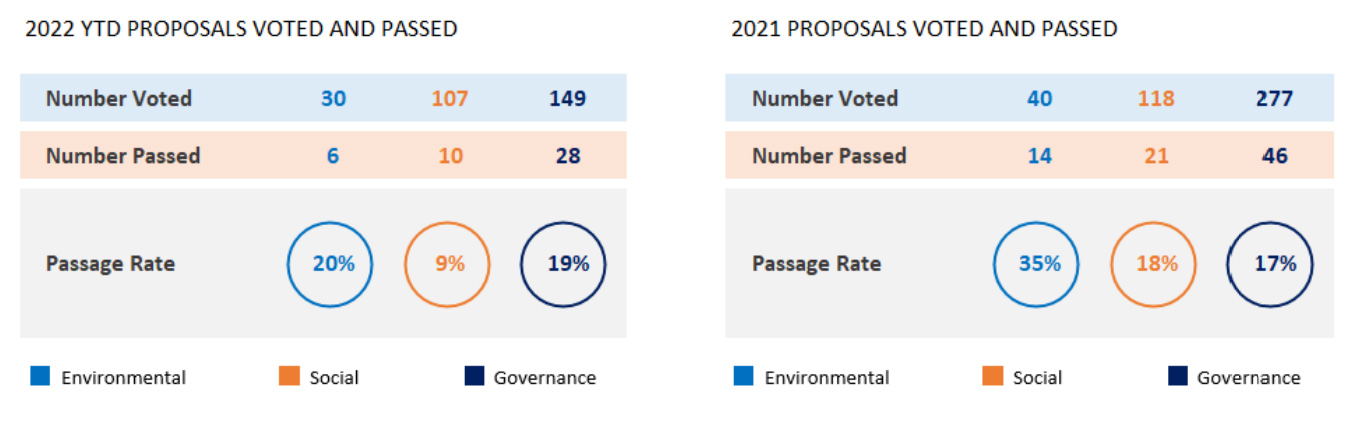

Georgeson’s data show that only 20% of environmental proposals so far in 2022 have passed (6 of 30) compared to 35% (14 of 40) last year, and only 9% of social proposals have passed (10 of 107), compared to 18% (21 of 118) in 2021.

Notably, the report shows twice as many proposal submissions that are critical of the evolving ESG landscape (52 in 2022 so far compared to 26 in 2021) from three primary proponents usually associated with more conservative views on ESG issues – Steven Milloy, The National Legal and Policy Center and the National Center for Public Policy Research.

“We believe that the early signs of muted support for proposals on E&S matters do not necessarily indicate decreased investor focus on these issues, and more likely reflect the response of investors to a shift in emphasis in some proposals and heightened demands among others,” said Hannah Orowitz, US Head of ESG, Georgeson.

“Proponents seem to be evolving their approach and adapting to the landscape by working with others on submissions this year in response to changes to Rule 14a-8, which now prohibits filing more than one shareholder proposal at a company meeting.

“In particular, there seems to be more coordinated efforts between proponents and advocacy groups across the ESG spectrum, including members from Chevedden group, As You Sow and the Interfaith Center for Corporate Responsibility.”

The report also shows that a large number (206) of withdrawn proposals focused on specific E&S areas.

This suggests that companies were particularly engaged with their shareholders on these topics to garner support or understanding this year.

Additional early-season findings

- To date, only one DEI proposal passed of the six that went to a vote

- Two racial equity and two civil rights audit proposals have passed, with average support of 59% in 2022. Last year, no racial equity proposals passed, and Georgeson said it expects that these proposals will continue to receive high support this year

- The equal employment opportunity (EEO-1) disclosure proposal submissions saw a dramatic decrease in 2022 compared to 2021 (7 vs 47), and all but two such proposals have been withdrawn.

- 17 Russell 3000 companies have failed to receive majority support for their Say on Pay proposals in the 2022 AGM season, with 5.3% receiving “red zone” (50 to 70%) vote support. Average support for Say on Pay proposals to date is roughly in line with support experienced in the 2021 proxy season (90% in 2022 compared to 91% in 2021).

- So far this season, 15 director nominees from Russell 3000 companies have failed to receive at least 50% shareholder support. Seven failed because of a majority vote standard for director elections at their respective companies. The remaining eight directors were elected (or re-elected) where plurality vote standards were in place, meaning that a director only needed to receive one more vote to win.

Georgeson has collected and published statistics on corporate governance trends since 1987, the year institutional investors first sponsored shareholder proposals.

The report is available at https://www.georgeson.com/us/insights/2022-early-proxy-season-review.