Companies are opening their eyes to their obligations for action and disclosure on environmental, social and governance (ESG) issues, either as a response to investor demand, recognition of the risk mitigation benefits and opportunities, or because changing regulatory requirements. Understanding your ESG rating is key to staying one step ahead of your competitors. It shows how you compare in your industry and helps identify where you need to improve on ESG.

How does a strong ESG position create value?

Regardless of how ESG considerations currently factor into your strategy and operations, it doesn’t have to be difficult to make progress. It’s no secret that companies with strong ESG practices reap the rewards. It is becoming increasingly clear that monitoring ESG scores matters to effective investor engagement and reduced risk. It can also help reduce costs, improve top-line growth, increase productivity and minimize legal intervention.

Compare and keep pace

With ESG issues top of mind for investors, it’s important to know how your company’s position is perceived in comparison to investor favored standards and frameworks, as well as your sector peers. Many investors often make their investment decisions based on peer group comparison, so it’s important to ensure that your disclosures are up to standard. Benchmarking is not only useful in helping you keep pace, but it’s integral in helping you identify key areas for improvement. Studying industry leader best practices can assist you in managing and reducing ESG risks, while also highlighting new opportunities for success.

Awareness and expectations concerning ESG reporting, while not new, have been amplified over the last 12 months, with a particular focus on increased disclosure of data and metrics. Over 90% of S&P 500 companies published sustainability reports and on the heels of those disclosures, many institutional investors reported increasing dissatisfaction with companies’ disclosure of ESG risks, as well as a lack of consistent and comparable disclosure of key ESG metrics and data.

Top five reporting frameworks and standards

CDP — formerly the Carbon Disclosure Project

CDP runs a global disclosure system that enables companies, cities, states and regions to measure and manage their environmental impacts, specifically climate change, deforestation and water security. CDP aims to motivate investors, companies and cities to work towards a sustainable economy using its database of self-reported environmental data.

GRI — Global Reporting Initiative

GRI provides disclosure standards for companies to communicate their impact on key sustainability issues such as climate change, human rights, governance and social well-being. GRI uses a modular approach of three universal standards applicable to all companies and three topic-specific standards — economic, environmental and social — that companies can choose from to report on.

CSRD — Corporate Sustainability Reporting Directive

ISSB — International Sustainability Standards Board

ISSB has taken place of SASB, integrating it’s previous 77 industry specific standards and climate reporting framework. Managed by the IFRS the ISSB standards are intended to help align reporting across different markets on sustainability topics, Thee standards are available for individual sector download through IFRS Foundation website. These standards are being developed with specific use for financial markets to elicit decision-useful financially material information. Accordingly, its standards focus on sustainability risks and opportunities viewed as reasonably likely to impact financial performance and enterprise value.

TCFD — Task Force on Climate-related Financial Disclosures

The FSB (Financial Stability Board) Task Force on Climate-related Financial Disclosures Framework was developed to facilitate consistent climate-related financial risk disclosures to provide information to investors, lenders, insurers and other financial market participants. TCFD’s recommendations are structured to elicit information regarding a company’s approach to climate-related risks and opportunities across four core pillars: governance, strategy, risk management and metrics and targets.

Accordingly, there is mounting pressure for companies to produce integrated ESG reports that align with the industry-specific standards set by the ISSB and the recommendations of the TCFD. In fact, the ‘big three’ asset managers — BlackRock, State Street and Vanguard — have expressed specific expectations that companies produce TCFD-aligned reporting. These metrics facilitate public accountability and enable transparent evaluation of a company’s success in achieving its purpose.

Many institutional investors — including those often found at the top of a company’s shareholder list, like BlackRock, State Street, Legal and General and Invesco, just to name a few — have revised their proxy voting guidelines to incorporate ESG reporting expectations and their intentions to vote against directors where concerns exist regarding oversight of material ESG risks. Accordingly, it’s important to understand how your existing disclosures and practices align with investor expectations. Making headway with your ESG strategy is now necessary to avoid putting a vote at risk.

ESG evolution

The ESG landscape is constantly changing. Sometimes it may seem as though it does so on a daily basis, making it difficult for companies to keep pace and stay abreast of any changes impacting their ESG strategy and disclosures.

Many leading companies have already begun to adjust their reporting practices to align with investor expectations, meaning there are many participants who are setting a ‘golden’ ESG standard. However, this is not without its significant challenges. Without adequate oversight into peer and industry practices, it’s common for these companies to find themselves falling behind their peers due to the constant progression of the ESG landscape.

The evolution of ESG is likely to continue for some time yet, further underscoring the need to understand which practices and disclosures are required in order to satisfy your investors’ expectations.

Top 10 ESG Data Providers

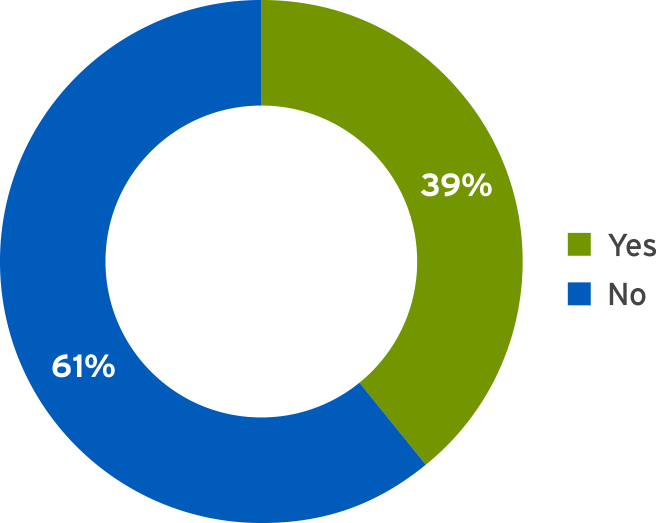

Prevelance of Proprietary ESG Platforms

Among Target Investors

Decoding the ESG ecosystem

Different organizations serve different purposes – do you know which ones matter to your investors?

Are you aware of the ESG initiatives that shape investors’ stewardship activities?

- Net Zero Asset Owners Alliance

- Net Zero Asset Managers Alliance

- Institutional Investors Group on Climate Change

- Investors for Opioid and Pharmaceutical Accountability

- Midwest Investors Diversity Initiative

- World Benchmarking Alliance

- Just Capital

Conclusion

Find out how your ESG practices, performance and disclosures compare to investor-favored standards and frameworks, your competitors and sector/industry peers.

An ESG gap analysis that takes your investors’ expectations and industry peer practices into consideration is vital information that can guide your ESG plan, whether you need to establish a strategy or further its development with specific, measurable targets and goals.

To inform what you should be doing from an ESG perspective, Georgeson will create for you an ESG appropriate peer group and conduct an analysis to identify your strengths, weaknesses and issues that may be just around the corner.

With Georgeson’s proprietary database, you will know exactly which standards and frameworks your investors prioritize, what ESG data sources they use and how your disclosures compare, so you can keep pace with your peers or set the standard.

No matter what stage in your journey, Georgeson will help you conquer your ESG challenges.

Our advisory services help you understand your own, unique ESG landscape, advance your practices and communicate with investors effectively.