Investor focus on ESG has produced a significant uptick in support of ESG-themed shareholder proposals. Climate change remains at the forefront of topics addressed in these proposals, with investors increasingly asking for corporate commitments to disclose greenhouse gas (GHG) emissions reduction targets. As the 2022 proxy season continues, we expect heightened interest in climate issues to generate greater voting support for environmental shareholder proposals, particularly with regard to measures related to goal-setting of emissions targets. At AutoZone, a shareholder proposal requesting Paris-aligned short, medium, and long term GHG reduction targets for Scopes 1, 2, and 3 received 70% shareholder support at the company’s December 2021 meeting. At Costco, a shareholder proposal requesting Costco adopt short, medium, and long-term science-based GHG reduction targets for Scopes 1, 2, and 3 received 67% shareholder support at the company’s January 2022 meeting

While expectations regarding climate goals vary by investor, company, and sector, most investors are moving in the same direction towards enhanced disclosure, interim targets, and more robust commitments to reduce GHG emissions. For instance, in its 2022 Guidelines, BlackRock asks companies to “set short-, medium-, and long-term science-based targets, where available for their sector, for greenhouse gas reductions and to demonstrate how their targets are consistent with the long-term economic interests of their shareholders.” Similarly, in its Guidance on Climate-related Disclosures, State Street notes its expectations for all companies to “offer public disclosures in accordance with the four pillars of the TCFD framework: Governance, Strategy, Risk Management, and Metrics and Targets.” State Street will begin taking voting action against companies that “fail to provide sufficient disclosure in accordance with the TCFD framework” beginning in this 2022 proxy season.

Considerations

For companies looking to introduce or improve upon climate targets, or for investors looking to assess corporate climate commitments, we highlight the following questions that should be considered:

What type of climate goal is being committed to?

Currently, most of the agreed-upon climate definitions are in relation to country goals, not corporate goals. As a result, the lack of standardization in company-specific climate terms can cause confusion. Below, we highlight some general definitions of certain climate goals, but acknowledge there is still some debate on specific details.

| Carbon free | Carbon free climate goals (sometimes referred to as zero carbon) set a high baseline for decarbonization, requiring companies to produce electricity with zero carbon generation (nuclear, renewable, and some forms of hydro). |

| Net zero | According to the IPCC’s Special Report: Global Warming of 1.5°C, “Net zero emissions are achieved when anthropogenic emissions of greenhouse gases to the atmosphere are balanced by anthropogenic removals over a specified period.” Net zero generally refers to all greenhouse gas emissions (all CO2 and non-CO2 emissions). |

| Net zero carbon | A net zero carbon climate goal follows the same logic as net zero, except it is only applicable to CO2 emissions. At a global level, net zero carbon is often used interchangeably with carbon neutral. |

As previously mentioned, global climate terms do not perfectly translate into corporate climate terms. This is especially notable as it relates to “net zero carbon” and “carbon neutral” terminology. Although the terms are often used interchangeably, there is a nuance to using the terms when referring to corporate climate goals.

The Science Based Targets initiative (SBTi) has published its Net-Zero Corporate Standard, noting the lack of standardized definitions and stating that “[w]ithout adhering to a common definition, net-zero targets can be inconsistent, and their collective impact is strongly limited.” The standard provides a formal definition of the state of net-zero emissions:

“Companies shall set one or more targets to reach a state of net-zero emissions, which involves: (a) reducing their scope 1, 2 and 3 emissions to zero or to a residual level that is consistent with reaching net-zero emissions at the global or sector level in eligible 1.5°C scenarios or sector pathways and; (b) neutralizing any residual emissions at the net-zero target date and any GHG emissions released into the atmosphere thereafter.”

Key distinctions between SBTi’s definition and IPCC’s definition is that it requires emissions reductions across a company’s value chain at a pace that aligns with scenarios that limit global warming to 1.5°C. At the corporate level, carbon neutrality does not necessarily require a commitment to reduce emissions, only to balance the emissions produced and emissions removed.

How are emissions reported?

Like financial reporting, emissions reporting uses various methodologies that can influence the way information is presented. The GHG Protocol refers to two methods: (1) equity share, or (2) the control approach. Both are discussed below.

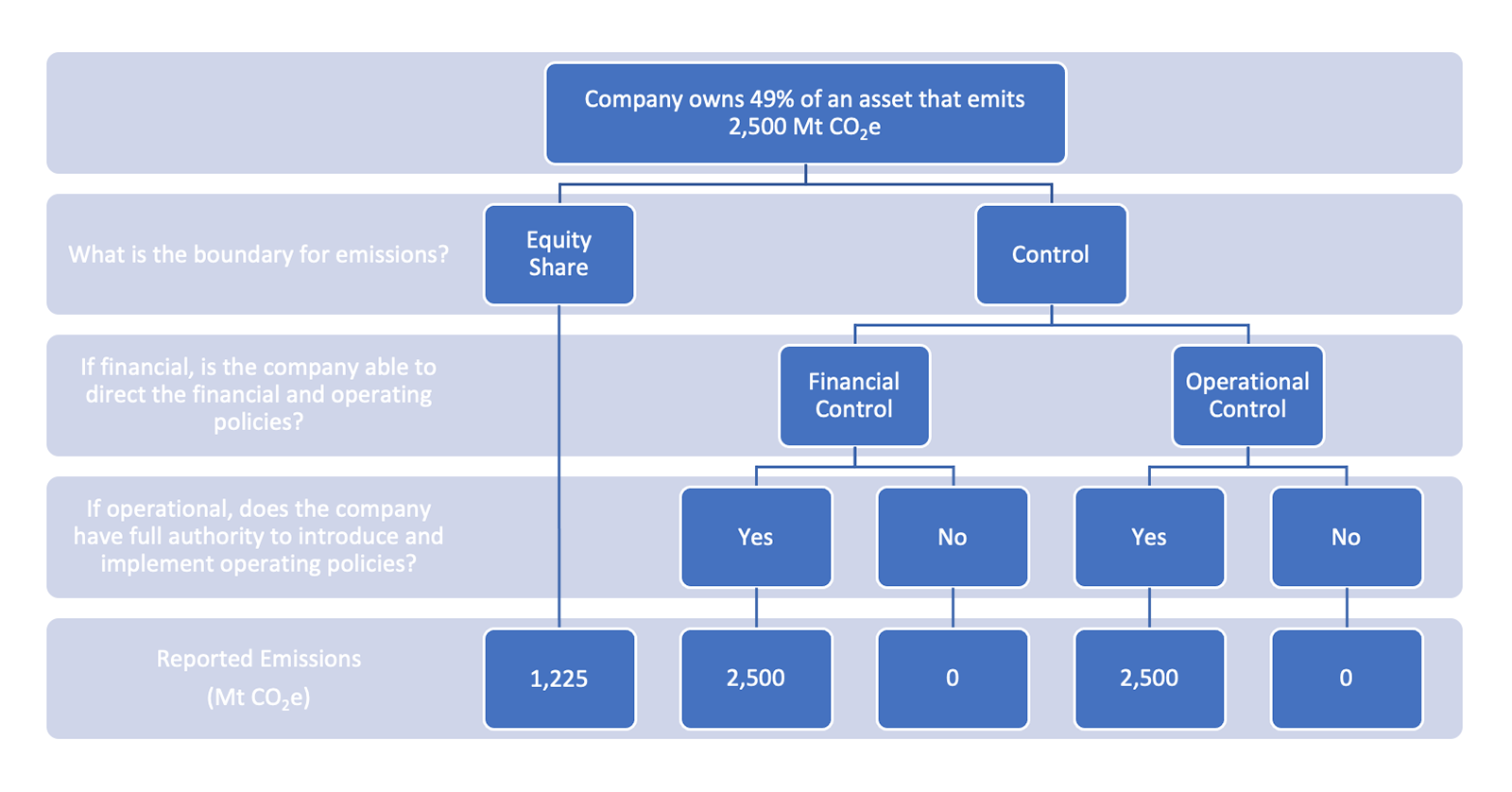

The decision to use an equity share or a control approach (otherwise known as the “boundary” for emissions reporting) influences the way companies report emissions. With equity share, companies report emissions from entities based on their ownership percentage in the entity. With a control approach, companies choose between financial control or operational control. Under financial control, companies account for emissions from entities where the company is a majority owner or has majority of the voting rights. This contrasts with operational control, which requires the company to have full authority to introduce and implement operating policies. Under this approach, the company reports 100% of the emissions for entities where it exercises operational control.

The following chart provides an example of how emissions reporting can vary depending on changes in assumptions. The example assumes a company owns 49% of an asset. For simplicity’s sake, we assume the asset is not considered a joint venture, as joint ventures have different reporting nuances.

Example of how reported emissions vary based on boundary

What emissions are included in target-setting?

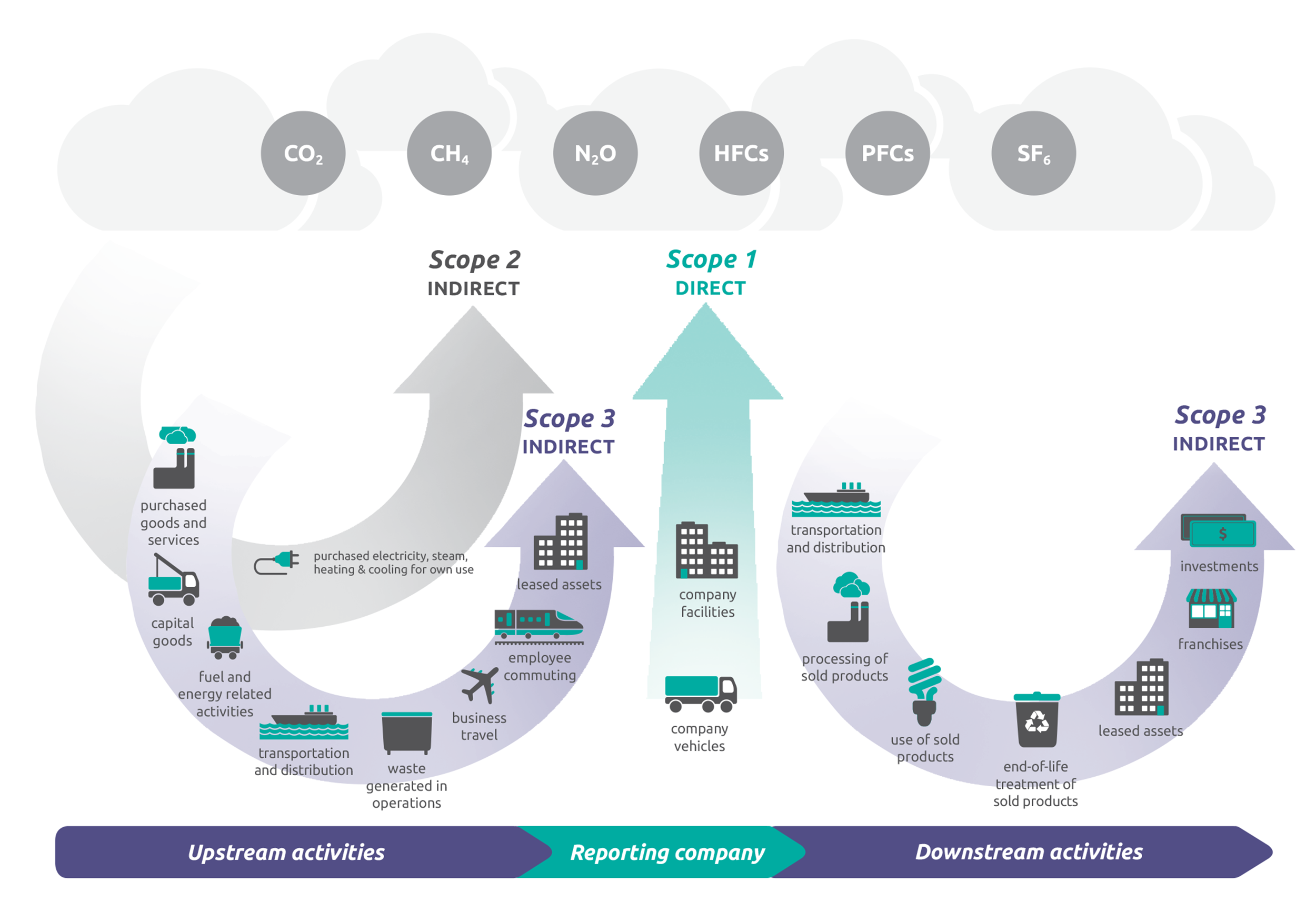

Emissions are reported under three primary scopes: Scope 1, 2, and 3. The GHG Protocol Corporate Accounting and Reporting Standard, which details standards and guidance for companies undertaking a formal emissions inventory, provides the following definitions:

- Scope 1: Direct emissions from owned or controlled sources

- Scope 2: Indirect emissions from the generation of purchased energy

- Scope 3: All indirect emissions not included in Scope 2 that occur in the value chain of the reporting company, including both upstream and downstream emissions

Conceptually, Scope 1 and 2 emissions are the emissions a company produces, whereas Scope 3 emissions are the emissions a company “enables.” Scope 3 emissions are especially significant for companies in the financial services or oil and gas sectors. For the financial services sector, Scope 3 emissions are akin to “financed emissions” – the emissions generated across a financial institution’s lending, insurance, or investment portfolios. For the oil/gas sector, Scope 3 emissions include all emissions made possible by using oil and gas.

Targets that cover Scope 1 and Scope 2 emissions are quickly becoming the minimum standard for goal-setting across sectors. For instance, BlackRock’s most-recent proxy voting guidelines note that their vote determinations will “continue to assess whether a company’s disclosures are aligned with the TCFD and provide short-, medium-, and long-term reduction targets for Scope 1 and 2 emissions.”

Increasingly, investors are looking for companies to set Scope 3 targets. Scope 3 emissions often represent a significant majority of a company’s total emissions, requiring the company to take a far more robust approach to emissions reductions. Scope 3 emissions are reported across 15 categories, emanating from a company’s upstream and downstream activities. These categories include fuel- and energy- related activities, end-of-life treatment of sold products, and waste generated in operations.

Overview of GHG Protocol scopes and emissions across the value chain

Source: WRI/WBCSD Corporate Value Chain (Scope 3) Accounting and Reporting Standard, page 5

For companies looking to set climate goals through the Science Based Targets Initiative (SBTi), targets must cover Scopes 1 and 2; if Scope 3 emissions are more than 40% of the combined Scopes 1, 2 and 3 emissions, the targets must also cover Scope 3.

Is the goal based on an absolute emissions reduction, or a reduction in emissions intensity?

Targets for absolute emissions reductions require companies to decrease the total amount of emissions. This contrasts with targets for reductions in emissions intensity, which focus instead on the rate of emissions created relative to a specific unit of productivity or economic output. Because intensity targets focus on the rate of emissions, absolute emissions could increase while emissions intensity decreases.

What constitutes an emissions reduction?

Not all emissions reductions are created equal and determining what constitutes an emissions reduction at the company level is nuanced. For example, consider a company that owns and operates coal plants. If the company chooses to retire the coal plant and thus eliminate the asset’s emissions, that impact would rightly count as an emissions reduction. Conversely, what if the company instead chooses to sell the coal plant to another entity? In this case, understanding whether the sale of this asset counts as an emissions reduction has significant implications. Ensuring that changes in ownership do not impact the emissions reduction progress (i.e.: adjusting out the emissions from any asset sales) provides a greater level of robustness in tracking progress.

What timeframe do the targets pertain to?

While 2050 tends to garner much of the headline attention, interim climate goals are beginning to generate more focus. Historically, lack of such interim goal-setting has resulted in effectively pushing decarbonization expectations further into the future, providing less visibility to near-term decarbonization strategies. Investors are increasingly asking for interim targets, though we note that much of the focus on interim target-setting is directed towards carbon-intensive industries. For example, State Street’s additional expectations around interim targets currently are only for carbon intensive industries (oil, gas, utilities, and coal).

What role do offsets and other netting activities play in the achievement of climate goals?

As previously mentioned, net zero climate goals can often incorporate some form of netting activities, such as carbon offsets. Carbon offsets are often grouped into two main categories based on whether emissions are avoided or removed. Offsets from avoided emissions traditionally involve activities that reduce emissions through preventing their release into the atmosphere, such as building a wind or solar farm. Offsets from removed emissions physically remove carbon from the atmosphere and sequester it.

Opinions vary on the appropriate ultimate role carbon offsets should play, as noted below:

- SBTi: The SBTi requires companies to “set targets based on emission reductions through direct action within their own boundaries or their value chains.” Offsets are only considered an option for financing additional emission reductions that go beyond a company’s science-based or net-zero target. Additionally, avoided emissions are not counted towards SBTs.

- CDP (formerly known as the Carbon Disclosure Project): CDP advocates for an “all of the above approach,” noting that there is a place for offsets. However, CDP emphasizes that the emissions reductions should be the primary focus, and that “companies can’t simply purchase offsets and then carry on with business as usual.” According to CDP: “Good offset projects should lead to real reductions or sequestration of carbon. They should be monitored, verified and must have concrete ownership.”

The previous list of questions is by no means exhaustive, but is instead meant to illustrate the ways subtle details in a company’s choices regarding emissions reporting and climate goal setting can result in meaningfully different outcomes. Although broad messaging might give the impression of uniformity or comparability across goals, understanding the specifics behind emissions reporting and reduction commitments is crucial.

Recommended next steps

Institutional investors continue to focus on emissions reduction targets, and we expect their requirements for disclosure and target-setting to become more stringent over time. Perhaps more broadly, the heightened focus on climate change has drawn greater attention to corporate climate practices and garnered increased investor support for environmental shareholder resolutions.

Accordingly, companies must determine what type of approach to take towards climate goals.

Setting robust, science-based emissions reduction targets requires a substantial effort. Companies looking to do so should prepare to conduct an emissions inventory and develop TCFD-aligned disclosure prior to 2023 annual meetings.

For more analysis on how changing expectations towards climate goals may affect your company, or to better understand the rapidly adapting ESG landscape, contact Georgeson.

If you have questions or comments, please email info@georgeson.com or call (212) 440-9800.