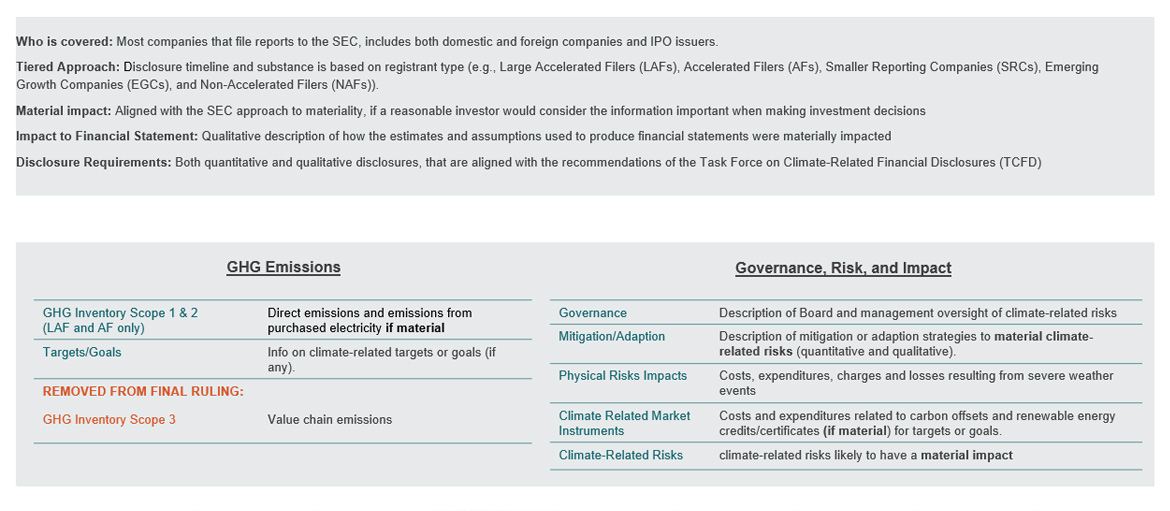

The long-awaited SEC Climate Rule has been finalized as of March 6, 2024. The scaled-down version of the original proposed rule places requirements on registrants (domestic and foreign issuers) to provide climate related disclosures. The rule covers requirements for the following areas:

- GHG emissions and assurance

- Financial statement effects disclosure, presented in a note to the Financial Statements

- Additional qualitative disclosures

Our memo summarizes the main changes put forward in the ruling. For more detail refer to the full rule here.

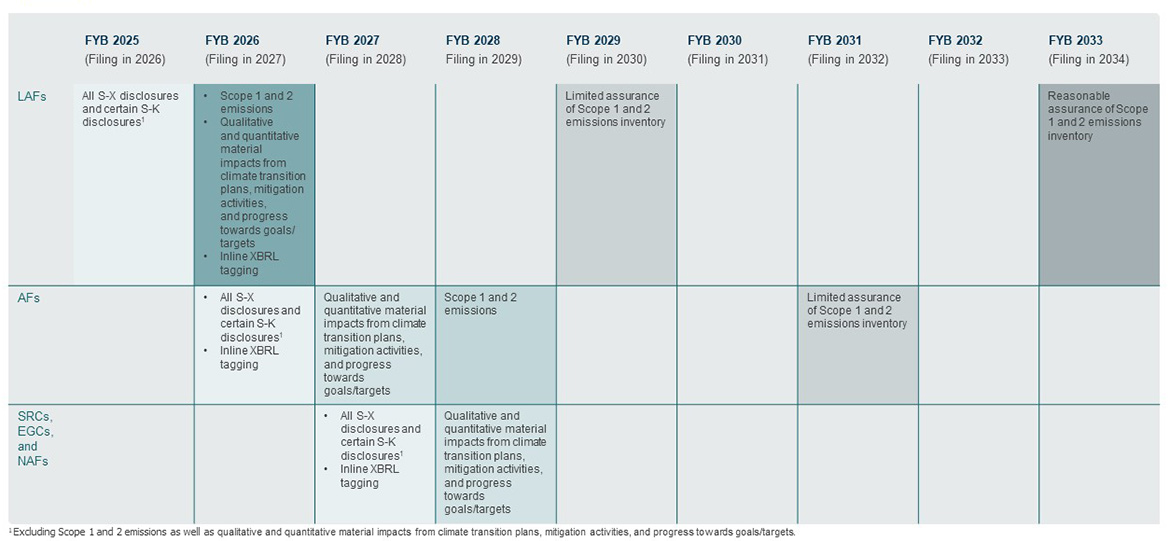

The final rule had significant revisions when compared to the original draft rule (see the summary of changes below). The timeline for how requirements of the rule will be phased in changed from the original timeline proposal, as did requirements for which type of filers will have to disclose which information.

One of the more substantial revisions is the introduction of materiality throughout the rule. For example, in the final rule, the requirements for Scope 1 and 2 emissions disclosure are subject to materiality. The rule clarifies that the SEC intends that a registrant apply traditional notions of materiality under the Federal securities laws when evaluating whether its Scope 1 and/or 2 emissions are material. This means that materiality is not determined merely by the amount of these emissions, but by the guiding principle of whether a reasonable investor would consider the disclosure of the registrant’s Scope 1 emissions and/or its Scope 2 emissions important when making an investment or voting decision, or such a reasonable investor would view omission of the disclosure as having significantly altered the total mix of information made available.

The major highlights for the final rule include:

Our memo provides greater detail of the final rule changes.

By taking a phased approach issuers will have more time to develop the appropriate systems and procedures to meet the reporting requirements relating to the rule. At the same time, by eliminating and modifying several requirements, including the requirement for disclosing Greenhouse Gas Emissions (GHG) for Small Reporting Companies (SRC) and Emerging Growth Companies (EGC), as well as removing reasonable assurance for Accelerated Filers (AF), the overall effort and expected costs to registrants to comply with the final rule has been reduced significantly.

The following timeline highlights when companies will need to act based on their filing type (where FYB = fiscal year beginning):

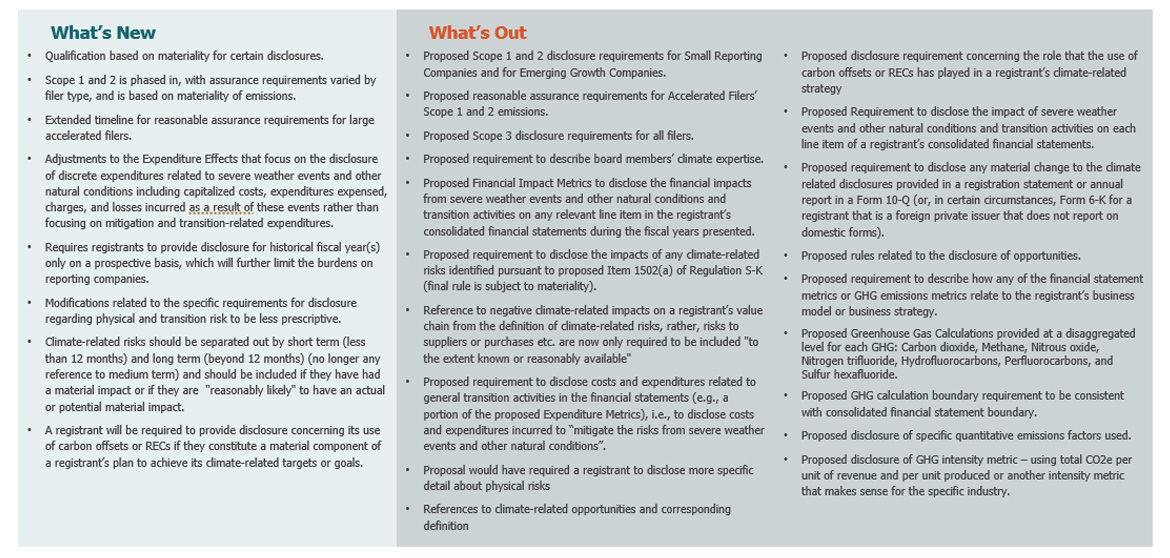

The final rule underwent significant revisions from the draft rule released in March 2022. Many have remarked that the final rule was been severely “watered down” from the proposed rules in response to the receipt of over 4,500 unique comments on the rule. One of the most heavily commented elements was the proposed inclusion of requirements to disclose Scope 3 emissions (otherwise known as value chain emissions) in the final rule. As the summary table below highlights, Scope 3 was not ultimately included in the final rule.

Our memo provides greater detail on the changes from the draft to final rule.

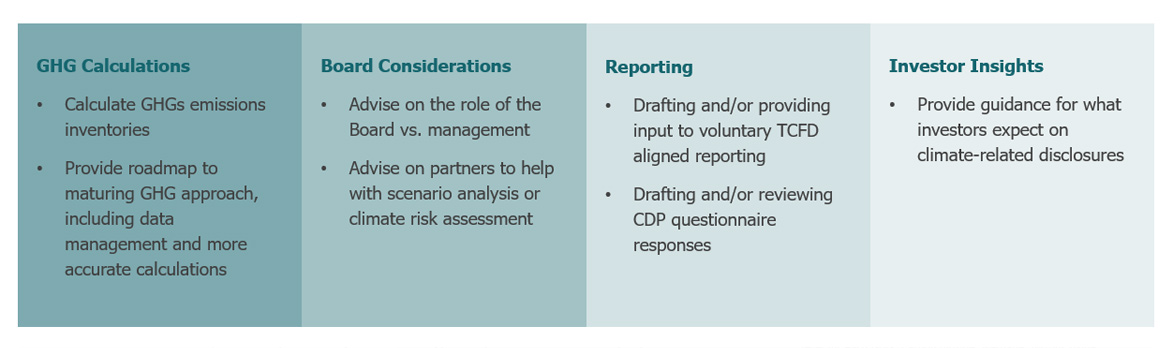

With the climate rule finalized, issuers should begin to consider how to advance their approach to climate to align with the eventual reporting requirements. While the rule is final, there are developments that every issuer should continue to monitor. What we’re watching in this next phase includes:

- Legal challenges to the final rule; there have already been legal challenges to the rule itself.

- How investors respond to the rule and any clarifications on expectations of issuers on determination of materiality.

At Georgeson we’re helping our partners consider what actions on climate makes the most sense for them. This includes supporting with:

Stay tuned for future webinars on this topic.

This notice is provided by Georgeson for general informational purposes only and is not intended and should not be construed as legal, regulatory, financial or tax advice. Georgeson is not licensed or authorized to practice law in any jurisdictions and hence does not provide any legal advice and it does not hold itself out as doing so. Neither Georgeson nor any of its affiliates or contributors accept any responsibility or liability for the quality, accuracy or completeness of any information contained in this notice. It is important that you seek independent professional advice relating to the subject matter of this notice before relying on it.