On March 18, State Street Global Advisors (SSGA) released their 2019 Proxy Voting and Engagement Guidelines and, for the first time, their new Global Proxy Voting and Engagement Guidelines for Environmental and Social Issues. This follows the January 15 release of SSGA's annual Proxy Letter, with its theme of aligning corporate culture with long-term strategy. Below, we summarize the Proxy Letter and the updated voting and engagement guidelines and take a brief look at the impact of one of SSGA's policy updates from last year.

Proxy Letter: Aligning Corporate Culture with Long-Term Strategy

Perhaps to address critics of the value of environmental and social (E&S), SSGA President and CEO Cyrus Taraporevala goes out of his way in his first turn with the annual note to frame SSGA's E&S concerns as about "value" not "values" and to describe the purpose of their engagements as about driving long-term, sustainable performance as opposed to "a political or social agenda." The letter references "effective, independent board leadership; board quality including cognitive diversity enhanced by better gender diversity; and environmental sustainability" as areas of engagement that are illustrative of SSGA's concerns.

The focus of the letter this year is on corporate culture. While acknowledging that corporate culture is a difficult asset to measure and manage, SSGA believes that it and other intangibles are increasingly "… driving a greater share of corporate value."

According to SSGA, its engagements have found that "few directors can adequately articulate their company's culture" and that boards "sometimes fail to adequately ensure that the current corporate culture aligns with corporate strategy." SSGA has created a framework to help companies and boards address these issues. Broadly, SSGA's framework asks portfolio company boards to "proactively review and monitor corporate culture, evaluate its alignment with strategy, and incentivize management to take corrective action, if necessary." Specifically, boards should oversee senior management's undertaking of three key exercises:

Comparative Analysis – Companies first need to establish the degree to which current culture and long-term strategy are aligned. If alignment exists, they should identify key drivers for perpetuating it. If alignment does not exist, they must establish which practices or agents should change to pursue closer alignment.

Implementation – Once a company establishes a level of alignment, it can implement mechanisms to influence and monitor progress. Indicators that reflect the desired culture (e.g., "employee turnover, retention rates, employee satisfaction survey results, diversity and inclusion dimensions, and pay differences among their employees across divisions and job functions") may need to be identified and it may be appropriate to tie these indicators to incentives. While senior management is in the best position to drive cultural change, the board should oversee this process and there should be a mutual understanding of expectations between the board and management for implementation.

Reporting – Companies need to establish communication channels to influence culture "in an effective and consistent manner," perhaps including an annual update on activities and actions taken. Ultimately, SSGA says that there are "few companies that can effectively communicate their board's involvement in influencing culture." As this topic is being prioritized for the stewardship program's engagements, many companies should expect another opportunity to communicate that involvement in the coming months.

2019 Proxy Voting and Engagement Guidelines: North America (United States and Canada)

SSGA continues to note their founding involvement with the Investor Stewardship Group (ISG) and the attendant monitoring of companies' adherence to the ISG Corporate Governance Principes. They also note that they are a signatory to the United Nations Principles for Responsible Investment (UNPRI). Both should serve as guideposts for companies looking for insights into SSGA's engagement principles.

Material updates to the 2019 Guidelines include two items relevant to the U.S. market: a North America update to the board gender diversity policy and a global update to engagement and voting on E&S issues, both of which are summarized below.

Board Diversity

SSGA has enhanced their current board diversity policy to "further encourage companies to diversify their boards." Starting in 2020, it will vote against the entire nominating committee "if a company does not have at least one woman on its board and has not engaged in successful dialogue on SSGA Global Advisors' board gender diversity program for three consecutive years."

Environmental and Social Issues

SSGA's current North American Guidelines include the same Environmental and Social Issues section as the 2018 Guidelines, but the updated version discusses SSGA's "comprehensive approach" to engagement and frames such engagement – including proactively through their Asset Stewardship prioritization process – as a way to "mitigate sustainability risks" in their portfolio. SSGA further directs companies to their new "Global Proxy Voting and Engagement Guidelines for Environmental and Social Issues," discussed below, for more detailed insights into their voting and engagement processes as they relate to E&S.

Global Proxy Voting and Engagement Guidelines for Environmental and Social Issues

SSGA opens its first guidelines dedicated to E&S with a commitment to their primary fiduciary obligation to maximize long-term returns. In our view, this approach supports the growing body of research that suggests that certain sustainability issues may create material risks and opportunities and that responsible asset managers will increasingly work to mitigate and maximize them respectively.

SSGA's new global E&S guidelines address their efforts in this area by providing transparency related to: 1) assessing materiality and relevance; 2) engagement; and 3) voting.

Materiality and Relevance

SSGA uses several "frameworks as well as additional resources" to assess materiality of a given E&S issue at a particular company, including:

- The Sustainability Accounting Standards Board (SASB) Materiality Map

- The Task Force on Climate-related Financial Disclosures (TCFD) Framework

- Disclosure expectations in a company's given regulatory environment

- Market expectations for the sector and industry

- Other existing third-party frameworks, such as the CDP (formally the Carbon Disclosure Project)

- R-Factor score (a proprietary SSGA metric that aligns with the SASB materiality map)

Engagement

SSGA approaches its E&S engagement efforts from a global perspective, and addresses engagement topics and targets in two ways: proprietary screens and thematic prioritization. For proactive outreach, SSGA uses proprietary screens, including their R-Factor score, to identify sector and industry outliers for engagement. Alongside this process, they identify "thematic sustainability priorities" to address in general engagements, e.g., board diversity.

Voting

SSGA affirms their case-by-case approach to voting on E&S shareholder proposals relating to sustainability and will consider:

- Materiality

- Content and intent

- "Whether the adoption of such a proposal would promote long-term shareholder value in the context of the company's disclosure and practices"

- Current level of board involvement in the oversight of sustainability practices

- Quality of engagement and responsiveness

- Binding nature or prescriptiveness of proposal

SSGA supports E&S shareholders proposals if the issue is material and the company has poor disclosure and/or practices relative to SSGA expectations. If there are moderate concerns with disclosures and/or practices, SSGA will abstain. If the issue is non-material and/or company disclosure and/or practices meet SSGA expectations, they will vote against the proposal.

Looking Back to 2018: Abstain on Say-on-pay

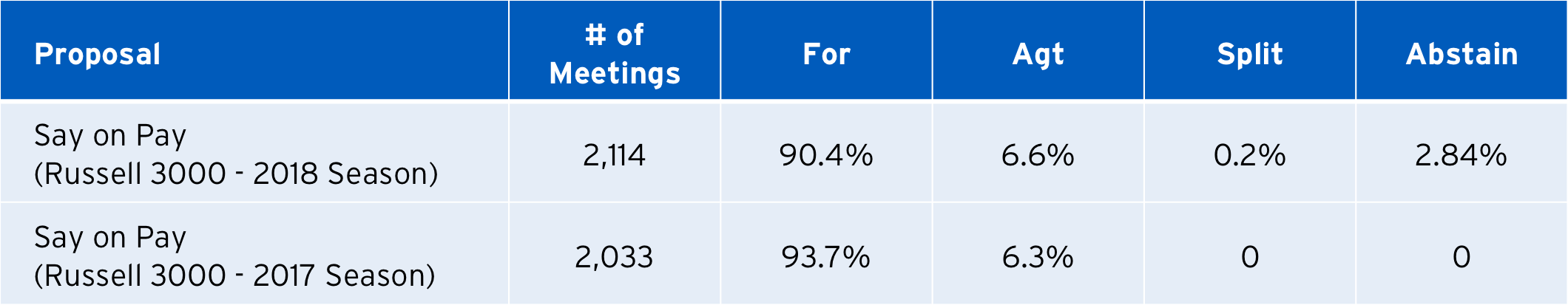

Last year, one of SSGA's notable policy updates introduced the possibility that it would vote to abstain on compensation-related proposals. According to the updated policy, companies whose compensation practices were misaligned with SSGA's expectations, but not so misaligned as to warrant an against vote, would now receive an abstention. A look back however, while by no means conclusive, seems to indicate that perhaps it was those companies whose for votes were on the bubble that were more likely to get an abstain. Sixty companies, or roughly 2.8% of the 2,114 Russell 3000 say-on-pay votes SSGA cast last season (10 of which appear to have received a for recommendation from ISS) received an abstention from SSGA this past season, but the percentage of meetings SSGA voted against remained stable. Abstentions are running ahead of their inaugural rate this year at 5.5%, with 15 cast at the 271 meetings voted so far.

Takeaways and Advice for Issuers

As one of the largest investors globally, SSGA's views on any issue can serve as a bellwether for tracking potential policy directions at other institutions. Boards and managements would do well to consider the broader philosophical positions inherent in SSGA's positioning of E&S engagement and voting in the context of traditional fiduciary obligations.

- Not only is this "fad" likely here to stay but additionally their focus on materiality and comply-or-explain regimes may highlight the path forward in areas many companies seem to be resisting, i.e., standard voluntary reporting on various material E&S factors and board involvement in potentially ambiguous directives like corporate culture.

- Specifically, companies can familiarize themselves with SASB's materiality map and consider the SSGA framework section for comparative analysis to better prepare themselves for conversations with the Stewardship Group.

- Companies can also rely on Georgeson for support in areas like assessing peer group disclosure, identifying the E&S or ESG policies of top holders, assessing the vote impact of a specific holder or engaging shareholders.

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.