Board Composition and Effectiveness

Overboarded directors

The most significant change relates to Vanguard's adoption of a new policy on overboarded directors. Under this policy:

The most significant change relates to Vanguard's adoption of a new policy on overboarded directors. Under this policy:

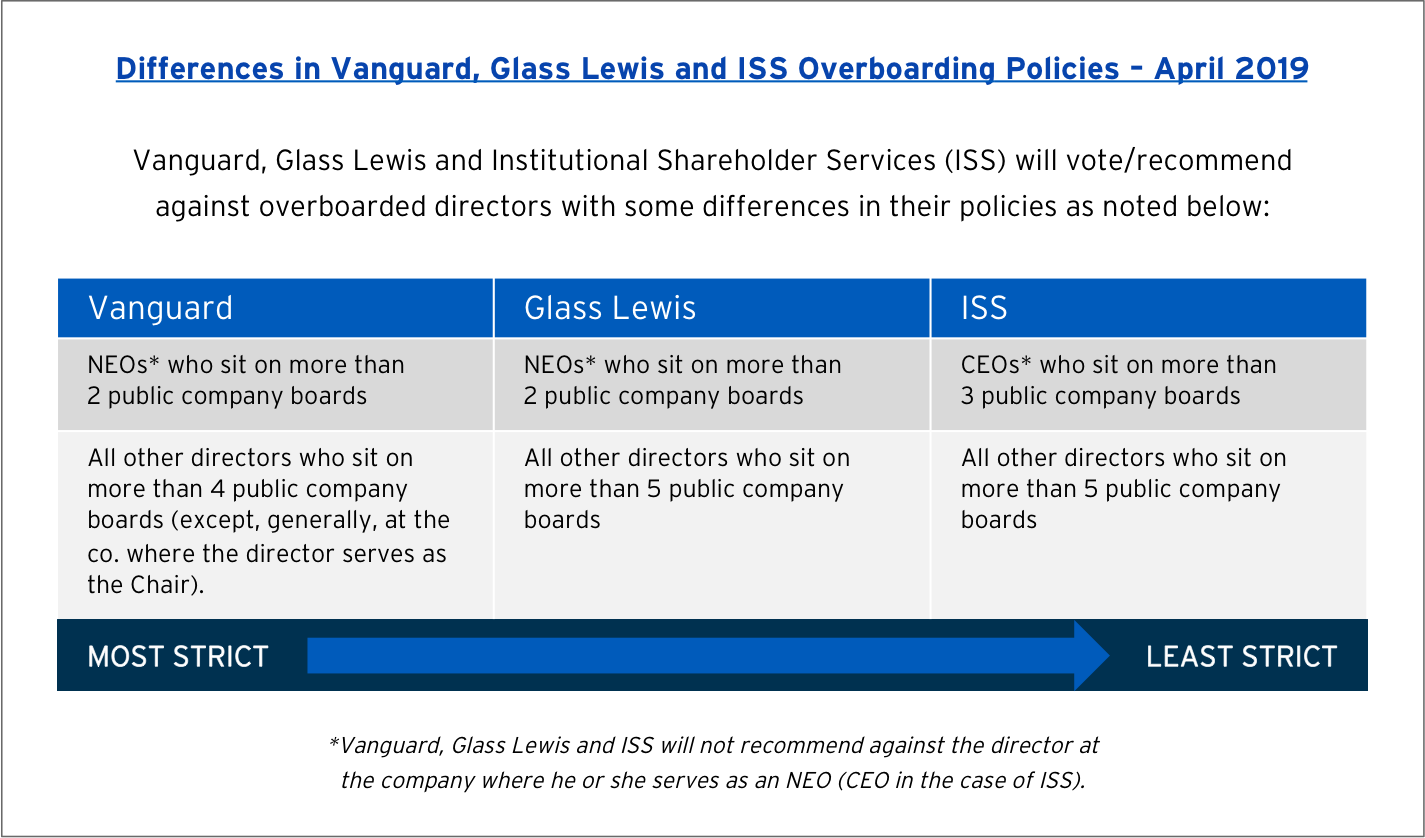

- Vanguard will vote against any director who is a named executive officer (NEO) and sits on more than one outside public board. They will vote against the director at each of these companies except the one where he/she serves as an NEO.

- Vanguard will also vote against any director who serves on more than four public company boards. They will vote against the director at each of these companies except, generally, where he/she serves as chair of the board.

Vanguard may vote for an overboarded director if the director has publicly committed to stepping down from the additional boards to fall within the thresholds listed above.

Georgeson has identified 230 NEOs who sit on more than two public company boards who are likely to be affected by this policy. Similarly, there are 142 non-executive directors who sit on more than four public company boards. Most of the affected directors and companies are likely not to have adequate time to address the overboarding issue for the current proxy season. The companies whose director(s) would run afoul of the above mentioned board limits should consider reaching out to Vanguard to communicate any potential reduction in board memberships that an affected director may be considering. The companies should also consider providing any information or context that would help explain or mitigate any overboarding concerns (which primarily relate to director effectiveness and ability to devote adequate time and attentiveness to each board position).

Escalation process: director and committee accountability

Vanguard has updated its policy to provide that it will vote against certain directors in cases of perceived governance failings or to escalate an unaddressed issue. While many of the topics addressed under this process were included in Vanguard's prior guidelines, the escalation process is a notable revision to the guidelines, as are some of the thematic categories. The key additions are noted below.

Lack of majority board independence

- For the first year, in addition to voting against the non-independent directors, Vanguard will vote against the members of the nominating committee of a non-controlled company.

- In the second year of a non-majority independent board, Vanguard will escalate its opposition to vote against the entire board.

Lack of 100% key committee independence

In further support of Vanguard's existing view that key committees should be composed entirely of independent directors, it has refined its guidelines to provide that where a key committee is not composed entirely of independent directors:

- For the first year, in addition to voting against non-independent members of the key committee, Vanguard will vote against the chair of the nominating committee.

- In the second consecutive year of a non-independent key committee, Vanguard will escalate its opposition to vote against all the members of the nominating committee.

"Zombie" directors

The issue of "Zombie" directors – directors who fail to get a majority of shareholder votes but remain on the board due to a plurality voting standard – is a new addition to Vanguard's policy. Vanguard will vote against the chair of the nominating committee if the board re-nominates so called "zombie" director(s) who failed to receive majority support and the board has failed to address the underlying issue driving shareholders' opposition to the directors(s).

Compensation-related situations

When voting against a say on pay proposal in consecutive years, Vanguard has added to its guidelines that it now will also vote against the compensation committee members in the second year, if the compensation committee has failed to make meaningful improvements to the executive compensation program in response to a poor say on pay vote. Similarly, if egregious pay practices are not addressed, Vanguard will vote against the full compensation committee in subsequent years if say on pay is not on the ballot (i.e., for companies with less than annual frequency of say on pay votes); and it will vote against compensation committee members when voting against an equity compensation plan, if equity plans and other pay practices are problematic.

Lack of responsiveness to shareholder proposals

Vanguard's revised guidelines now clarify the specific directors from whom it will withhold support in case of non-responsiveness to shareholder proposals. Vanguard will vote against the independent chair or lead independent director and members of the governance committee if the board fails to respond to a shareholder proposal that received the support of majority of financial ownership at a prior year's shareholder meeting.

Note, that Vanguard has made the distinction between financial and voting ownership to account for situations where certain shareholders (often insiders) hold disproportionately higher voting authority due to ownership of shares with super-voting rights. In such instances, a shareholder proposal may fail to receive majority vote support, although under one-share, one-vote principle, it would have received majority support.

Contested director elections

Vanguard has expanded the discussion of how it assesses contested director elections. In its case-by-case analysis, Vanguard has indicated three key areas of focus:

- The case for change at the target company;

- The quality of the company and dissident board nominees; and

- The quality of company governance.

In determining its vote, under these focus areas Vanguard will evaluate: the performance of the company relative to its peers; the board's oversight of strategy to deliver shareholder value; corporate governance practices at the company; the board's engagement with the dissident and other shareholders; and qualifications of the dissident nominees and their plans for delivering shareholder value.

Diversity and qualifications disclosure

To promote diversity on boards, Vanguard will support disclosure of a broad set of director characteristics, including race, ethnicity, national origin, age and gender through both its engagement and voting efforts. Accordingly, it has updated its voting guidelines to specifically address diversity-related shareholder proposals, providing that it will support such proposals if:

To promote diversity on boards, Vanguard will support disclosure of a broad set of director characteristics, including race, ethnicity, national origin, age and gender through both its engagement and voting efforts. Accordingly, it has updated its voting guidelines to specifically address diversity-related shareholder proposals, providing that it will support such proposals if:

- The proposal seeks disclosure related to directors' diversity or skills and qualifications, unless such information is already disclosed.

- The proposal asks companies to adopt board diversity related policies, unless appropriate policies already exist.

Independent chairman of the board

Vanguard has provided an expanded discussion of its policy position relating to independent chair shareholder proposals. Vanguard considers board leadership structure to be a board matter and will therefore generally vote against a shareholder proposal to separate the roles of chair and CEO, unless there are significant independence or board effectiveness concerns based on consideration of the following factors:

- Lack of a strong lead independent director role

- Lack of accessibility to independent board members through company policy or practice

- Low overall board independence

- Governance structural flaws such as multiple share classes with different voting right or key committees that are not fully independent

- A pattern of non-responsiveness to shareholders

- Governance failings such as unilaterally classifying the board

Oversight of Strategy and Risk

Environmental and social disclosure

Vanguard has expanded the discussion of its approach on environmental and social issues to provide distinct guidelines for both its approach to shareholder proposals requesting environmental/social disclosure and those requesting the adoption of targets, goals, or environmental/social policies or practices. In its case-by-case approach to environmental and social disclosure proposals, Vanguard notes that each proposal will be evaluated in the context that the board is ultimately responsible for oversight of strategy, including sustainability risks and opportunities that have a demonstrable link to long-term shareholder value. Accordingly, it is likely to support proposals that aim to address any disclosure gaps, reflect an industry-specific materiality-driven approach and are not overly prescriptive. In determining its vote, Vanguard may engage with the company and/or the shareholder proponent.

Vanguard has expanded the discussion of its approach on environmental and social issues to provide distinct guidelines for both its approach to shareholder proposals requesting environmental/social disclosure and those requesting the adoption of targets, goals, or environmental/social policies or practices. In its case-by-case approach to environmental and social disclosure proposals, Vanguard notes that each proposal will be evaluated in the context that the board is ultimately responsible for oversight of strategy, including sustainability risks and opportunities that have a demonstrable link to long-term shareholder value. Accordingly, it is likely to support proposals that aim to address any disclosure gaps, reflect an industry-specific materiality-driven approach and are not overly prescriptive. In determining its vote, Vanguard may engage with the company and/or the shareholder proponent.

Environmental and social policy and practices

Vanguard again takes case-by-case approach to proposals that prescribe adoption of environmental and social goals or policies and practices. However, the revised policy seems to suggest that its support of these types of proposals may be more limited, noting these proposals sometimes cross from governance into management territory, and that shareholders often do not have adequate information to judge whether management and the board have failed to implement an appropriate strategy. Interestingly, the guidelines note that if a proposal seems reasonable, Vanguard may engage with the company to understand its perspective and implementation of any related strategic priority, even if Vanguard does not support the shareholder proposal.

Workforce inclusion

Vanguard has added a section on workforce diversity/inclusion policies. Vanguard will vote for proposals seeking inclusion of sexual orientation, gender identity or minority status or protected classes in a company's employment and diversity policies, while it would vote against proposals seeking exclusion of such references in a company's Equal Employment Opportunity policy. Vanguard will vote case-by-case on proposals seeking disclosure of a company's workforce diversity or workforce compensation data.

Capitalization

Vanguard will now vote in favor of proposals seeking to increase authorized common stock amounts by up to 100% of the current share authorization. Previously, Vanguard supported an increase of up to 50%.

Compensation

Advisory votes on executive compensation (say-on-pay)

Vanguard recognizes that norms and expectations vary by industry type, company size, company age and geographic location and therefore, it has added guidelines intended to be preferences for executive compensation. Vanguard has added lists of issues that would raise "red flags" and "yellow flags" when it evaluates say on pay proposals.

Factors considered "red flags" include:

- Disproportionately high pay for low total shareholder returns, when compared to peers

- Long-term plan comprises less than 50% of total pay

- Long-term incentive plan with performance period of less than three years

- Incentive targets are reset, retested or not rigorous

- Above median benchmarking of total pay

Factors considered "yellow flags" include:

- Use of inappropriate peer group

- Incentive plans use absolute metrics but no relative metrics

- Plan allows for positive discretion but not for negative discretion

- Use of one-time (e.g. retention) awards

- Inadequate disclosure relating to plan structure or payout

Adopting, amending and/or adding shares to equity compensation plans

High dilution and excessive burn rate are two of the factors that are likely to cause Vanguard to vote against equity plan proposals. In its updated policies, Vanguard considers total potential dilution (including all stock-based plans) in excess of 20% of shares outstanding to be problematic. Previously, Vanguard allowed for up to 15% dilution. Vanguard has similarly increased the allowable burn rate (annual equity grants as % of shares outstanding) limit from 2% to 4%.

Non-employee director compensation

In its policy updates, Vanguard has added a section relating to nonemployee director compensation. Vanguard will vote case-by-case on director equity plan proposals taking into account potential dilution, size of the plan relative to employee equity compensation plans, annual grants to nonemployee directors and total director compensation relative to market.

Governance Structures

Special meetings and written consent

Vanguard has elaborated on its policies addressing shareholder proposals related to the right to call special meeting and to act by written consent by specifying the conditions that will influence its voting decision.

If a company does not provide shareholders a right to call special meeting, Vanguard will vote in favor of a shareholder proposal seeking to establish the right at as low as a 10% threshold. If a company already provides the right to call special meeting at a 25% or lower threshold, Vanguard will vote against a shareholder proposal seeking to lower the ownership threshold.

With respect to its support of shareholder proposals relating to action by written consent, Vanguard will generally vote in favor of the proposal if a company does not provide the right to call a special meeting.

Dual-class stockSupportive of "one-share, one-vote" principle, Vanguard would like to see newly public dual-class companies adopting a sunset provision to eliminate its unequal voting structure.

Considerations for Engagement with Vanguard

In its role as an engaged shareholder, Vanguard encourages companies to discuss their governance practices and principles through public disclosure or in engagements with Vanguard. Vanguard has published "Common questions for portfolio companies" that it would like companies to address on the topics of board composition, oversight of strategy and risk, executive compensation, and governance structures. Vanguard considers these four principles as the basis for long-term value creation by boards.

- Vanguard would like companies to discuss the director skills and experience considered critical to their strategy; how diversity is considered during the director selection process; and how oversight and effectiveness are assessed and ensured on the board and its committees.

- Vanguard wants companies to discuss the role boards play in the oversight of risk and strategy, and how risks are identified and mitigated.

- On executive compensation, companies should discuss how performance measures tie to the long-term strategy; goal setting process and the rigor of performance goals; peer group selection process; and the alignment of pay and performance relative to the peers and the market.

- Vanguard wants shareholders to have a voice on governance matters and would like companies to provide basic shareholders rights such as annual election of directors, proxy access, and a majority vote standard.

Vanguard has also published a guide for company boards and management on "Engaging with Vanguard". The guide provides an overview of the benefits of engagement, the four principles (as outlined above) that frame Vanguard's approach, and some practical engagement considerations.

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.