In February 2020, Massachusetts Financial Services Company (MFS) issued its 2020 Proxy Voting Policies and Procedures. The policy is largely unchanged from the company's 2019 report; the biggest changes for 2020 include clarification in voting uniformity, further detail around director support, and updates to its board diversity policy. The changes are summarized below. Georgeson's 2019 MFS voting policy summary can be found here.

Voting Consistency

In its recently published policy updates, MFS has added language to more explicitly describe its voting across its investment portfolios. Specifically, the company clarified that although it tries to vote consistently across all its funds and client accounts, some MFS portfolios might vote differently from one another. This could be for many reasons, most notably because the underlying client has instructed MFS to vote shares differently or because the portfolio manager (PM) believes that a different vote is in the best interest of the portfolio in the long-term. We will be monitoring to see if this clarification also means more instances of MFS splitting its vote in 2020.

Election of Directors

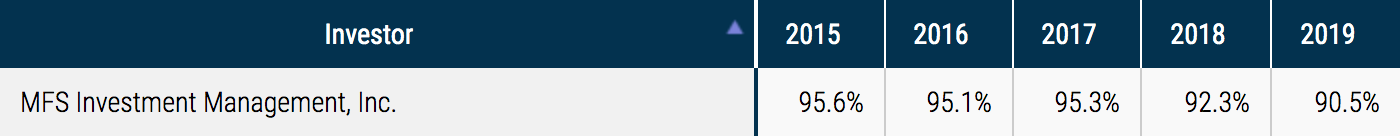

Historically, MFS has shown a high level of support for management's recommended directors, as reflected in the data below from Georgeson's 2019 Annual Corporate Governance Review.1 The table indicates MFS's frequency in voting in favor of director elections for companies in the Russell 3000 over the last five years. Notably, there has been a downward trend in support for directors since 2018. This decrease is most likely due to MFS's its introduction of policy changes requiring gender diversity and strengthening its stance on overboarding

Updates to Policy on Director Support

New this year, MFS has updated its director election policy and added information about how it views the tenure of the lead independent director in the context of its evaluation of the independence of the full board. The new policy states that, on a board where the role of chair and CEO are combined, if the lead independent director has served on the board for greater than 20 years, the independence of all of the director nominees will be evaluated on a case-by-case basis. In a report published on March 19, 2020, MFS provided a rationale for this change. MFS believes that the lead independent director should be a strong counterweight to the Chair/CEO structure, thereby ensuring the independence of the board. Accordingly, the MFS guidelines place an extra level of scrutiny on the lead director relative to the other directors.

Updates to Policy on Board Diversity

MFS continues to expect U.S. companies to have at least 15% female representation on the board. If there is less than 15% representation, MFS will generally vote against the chair of the nominating and governance committee. For 2020, MFS has expanded the scope of this policy to include all issuers in Canada and Europe. It has further stated that it may increase the minimum percentage of expected female director representation and/or expand application to issuers in other markets in furtherance of its belief in increasing female director representation at all public companies globally.

In general, MFS may consider the progress that a company is making to increase its board diversity. In this context, a company with less than 15% female representation on its board may benefit from enhancing disclosure and/or engaging with MFS on the steps they are taking to improve gender diversity. Finally, MFS recently joined 'The Diversity Project', sponsored by investment body NICSA.. This initiative promotes diversity in the Asset Management Industry.

MFS Voting History from Georgeson's 2019 Annual Corporate Governance Review

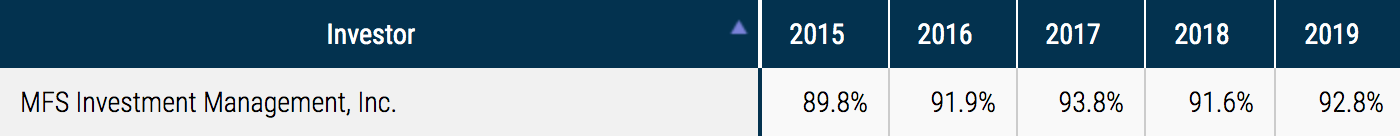

Say-on-pay Proposal Voting History – S&P 1500

MFS’s support for say-on-pay proposals has increased over the past five years, from 89.8% in 2015 to 92.8% in 2019. The table below indicates MFS’s support for say-on-pay proposals for companies in the S&P 1500 over the last five years.1

MFS's updated 2020 U.S. proxy voting policies can be accessed at https://www.mfs.com/en-us/individual-investor/resources/account-management/proxy-voting.html.

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.

1

Georgeson's 2019

Annual Corporate Governance Review, in partnership with Proxy Insight Ltd.