Following the publication of our 2019 Annual Corporate Governance Review, Georgeson is examining select topics in a series of "ACGR Insights" that provide in-depth analysis into select data sets. In our third ACGR Insights report, we compare voting behaviors of U.S. to non-U.S. investors on select climate-focused or adjacent shareholder proposals.

Report Thesis:

We believe investors' approaches to key U.S. shareholder proposal topics, including climate change, will become increasingly global. Asset owners are not restricted by geography when considering asset manager selection. As their clients' interests and expectations evolve – and as the Principles for Responsible Investment's (PRI) climate risk indicator reporting requirements become mandatory for signatories beginning in 2020 - asset managers must integrate ESG strategies into their investment and stewardship activities. As asset owners become more focused on climate-related risks and opportunities, non-U.S. headquartered asset managers may become increasingly influential, both directly as they compete for allocations and indirectly as special interest groups highlight these investors' more climate-forward policies. Companies will be well-served to understand foreign managers' voting patterns on climate-related proposals.

Research Approach:

To analyze differences in shareholder proposal voting behavior between U.S. and foreign-based asset managers, we examined voting outcomes at S&P 1500 companies during the 2019 proxy season which had a shareholder proposal within any of the following three categories:

Require Independent Board Chair

Environmental Issues

Political Lobbying and Contributions

BlackRock

United States

Vanguard Group, Inc.

United States

State Street Global Advisors

United States

BNY Mellon

United States

T. Rowe Price Associates, Inc.

United States

Legal & General Investment Management

United Kingdom (England)

Aberdeen Standard Investments

United Kingdom (Scotland)

BNP Paribas Asset Management

France

Norges Bank Investment Management

Norway

UBS Asset Management

Switzerland

A discussion of voting behavior for each proposal category follows.

Require Independent Board Chair

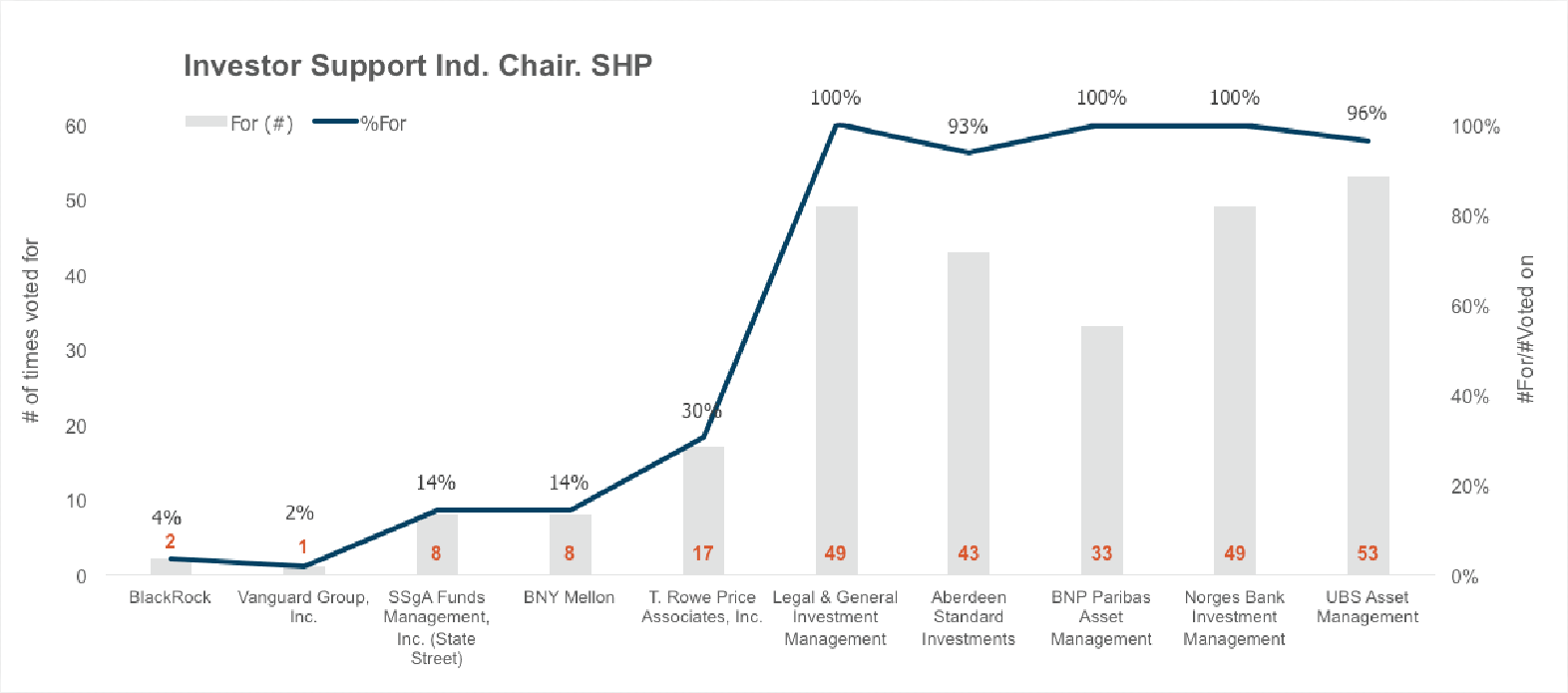

As reported in our 2019 Annual Corporate Governance Review, shareholder proposals seeking to require an independent board chair represented over 70% of the board-related proposals that reached a vote in the 2019 proxy season.1 While no proposals received majority shareholder support, proposals approached or crossed a 40% support threshold at six companies: Exxon Mobil Corporation, HomeStreet Inc., IBM, Sempra Energy, AT&T Inc. and Dominion Energy Inc. Looking closely at how the 10 investors voted on the proposal, you can see a divide in voting behavior of U.S. and non-U.S. investors. The U.S. investors collectively voted for an aggregate average of 13% of these proposals, whereas the non-U.S. collectively voted for 98% of the proposals in aggregate. Based on early season voting results (through May 6, 2020), average investor support for these proposals appears to have increased materially year over year. Accordingly, we expect we may see some incremental increase to the U.S. investors’ average support once full 2020 season data is available.

The chart below notes the number of times each asset manager voted in favor of an independent board chair proposal during the 2019 proxy season, with a trend line above demonstrating their overall support level of the proposal. For example, BlackRock voted for two such proposals, which represented just 4% of the total number independent chair shareholder proposals on which it voted. Meanwhile, Legal & General voted for 49 such proposals, or 100% of the proposals on which it voted. Legal & General's voting behavior indicates that, in line with its policies, it strongly supports division of the roles of chair and CEO: in its 2019 policy Legal & General indicated it would be voting against any director that holds a combined Chair/CEO position beginning in 2020.2

Environmental Issues

In 2019, shareholders submitted over 380 environmental- and social-related proposals to companies in the S&P 1500; 160 of these proposals reached a vote. Compared to 2017 and 2018, there was a significant decrease in the number of environmental proposals that went to a vote in 2019.1 We believe this decrease is largely attributable to increased engagement between companies and proponents, resulting in negotiated withdrawals of many proposals. In 2020, we are continuing to see companies proactively adopt and disclose sustainability and environmental policies and targets.

Given the broad scope of subjects addressed by environmental proposals (such as climate change, greenhouse gas, sustainability reporting, plastic waste), to meaningfully compare U.S. to non-U.S. voting behavior within this proposal category we examined voting behavior on shareholder proposals relating specifically to Greenhouse Gas Emissions. These include proposals seeking companies to provide quantitative reporting or to establish emissions goals. Non-U.S. investors in aggregate supported 89% of these proposals; U.S. investors in aggregate supported 20%. This disparity in support levels is of particular interest given that many large U.S. asset managers have promoted a new focus on E&S issues in recent years, specifically asking for more disclosure from companies. Notably, in January 2020, BlackRock announced its decision to join the Climate Action 100+ coalition. In addition, BlackRock's 2020 U.S. voting policy has been updated to include its expectation that companies provide disclosure aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and Sustainability Accounting Standards Board (SASB) standards. These policy updates also formalize a willingness to increasingly vote against boards (and in favor of relevant shareholder proposals) where companies are not making progress in their disclosure or management of sustainability matters such as climate change. State Street has also articulated an intention to vote against boards that, in its view, are not appropriately overseeing sustainability matters. Accordingly, going forward we may find these U.S. asset managers leveraging their voting authority over perceived 'laggards' to support environmental shareholder proposals (or vote against directors responsible for oversight of the risks these proposals address) with increased frequency. Indeed, there are several instances where this has been the case already during the 2020 proxy season.

Political Lobbying and Contributions

Given the run-up to the 2020 US presidential election, it is unsurprising that shareholder proposals relating to political lobbying payments and/or contributions were a significant focus in 2019. 64 related proposals went to a vote in 2019, with an average support level of 33%. In 2017 and 2018 no such proposals received majority support. In contrast, in 2019, the proposal received majority shareholder support at three companies.1

Examining the voting behavior of the 10 investors included in this ACGR Insights report provides some additional detail on this proposal's unexpected strong performance. Among the five U.S. investors, there is a distinct division in support for these proposals across investors: BNY Mellon and State Street supported approximately half and one-third of these proposals, respectively, whereas Blackrock, T.Rowe Price and Vanguard support ranged from 0% to 5%. In contrast, across the non-U.S. investors there were much higher levels of support – all non-U.S. investors supported at least 90% of the proposals on which they voted, with the two highest supporters being Legal & General supporting 100% of the 61 they voted on, and UBS supporting 98% of the 64.

| | BlackRock | Vanguard | SSgA | BNY Mellon | T. Rowe Price | Legal & General | Aberdeen | BNP Paribas | Norges Bank | UBS |

|---|---|---|---|---|---|---|---|---|---|---|

| % Times Voted For | 5% | 0% | 36% | 54% | 3% | 100% | 91% | 97% | 90% | 98% |

| Total # of Proposals Voted | 64 | 64 | 64 | 63 | 64 | 61 | 55 | 39 | 52 | 64 |

As the ongoing COVID-19 pandemic evolves, we believe it is likely that proponents will continue to focus on corporate lobbying and political spending, and that U.S. investors' support of such proposals may continue to trend upwards. Socially conscious investors will likely focus in particular on industries most negatively impacted by the pandemic and companies receiving funds from the CARES Act rescue relief that do not provide transparent political and lobbying disclosure.

Conclusion

As investors globally increasingly collaborate through industry frameworks and standards such as the Investor Stewardship Group and SASB, as well as through collective engagements led by Ceres, Climate Action 100+, Majority Action and many others, we believe U.S. asset managers' engagement priorities and voting patterns may be influenced by those of foreign asset managers. As the voting data in this ACGR insights report illustrates, foreign investors in 2019 were multiple times more likely to support shareholder proponents than were their U.S.-based brethren. With the rising tide of sustainability expectations expressed by major asset managers, the delta between U.S. and foreign investors' voting patterns may begin to narrow. Also, we would be remiss not to mention the significant impact the PRI plays in many asset managers' shifting expectations. Being a signatory to the PRI, as all of the investors in this research are, has effectively become a requirement for asset managers seeking institutional mandates. The PRI in turn has heightened its requirements placed upon signatories in recent years. Beginning in 2016, the PRI's increased willingness to remove as signatories investors that do not sufficiently demonstrate the alignment of their investment activities with PRI principles undoubtedly led to increased transparency around investors' stewardship activities. Beginning this year, the PRI will require asset managers themselves to provide TCFD-based reporting with respect to their investment activities, which may explain in part the increased focus on climate-related matters across major U.S. investors. These developments taken together suggest companies should be prepared for increasingly adverse voting activity in coming proxy seasons if they do not meaningfully address sustainability matters of importance to their key investors.

If you have questions or comments, please email info@georgeson.com or call 212 440 9800.

1 Annual Corporate Governance Review. Georgeson.

2 2020 Legal & General Investment Management Policy Updates. Georgeson.