In April 2019, Legal & General Investment Management (LGIM) released updates to its Corporate Governance and Responsible Investing policy documents that set forth its expectations for portfolio companies with respect to environmental, social and governance (ESG) issues. LGIM maintains a Global Principles policy in addition to region-specific policies. This alert discusses updates to LGIM's Global and North America proxy voting policies.

Executive Summary

LGIM is UK-based and consequently is at times more progressive1 or prescriptive than its U.S. counterparts with respect to its corporate governance expectations. Accordingly, its policy changes can provide useful foreshadowing of relatively established practices across the pond that are not yet common among U.S. institutions but may become so in future years. For example, with respect to gender diversity at the board level, LGIM's 2019 updates to its North America policy introduce specific gender diversity targets beginning in 2020 for companies within the S&P 500. While this update is not surprising against the backdrop of the government-backed target in the UK that women hold 33% of board seats by 2020, LGIM is one of the first institutions to introduce a specific target for U.S. issuers. Other notable updates, applicable to both LGIM's Global and North American policies unless otherwise noted, include:

- A stronger stance on combined chair/chief executive officer (CEO) roles beginning in 2020, whereby it will vote against the (re)election of any individual holding a combined role

- A new section on culture, specifically seeking disclosure of how the board oversees company culture

- A stronger position on how ESG factors can influence its voting decision, and

- In its Global policy, a revision to its CEO overboarding policy to limit CEO service on outside boards to one other board, which brings its Global policy in line with its existing North America policy.

Additional discussion of each of these updates follows below. While the North America policy appears to have been extensively revised, the majority of the revisions appear to be due to a restructuring of its approach to disclosure of its policies by incorporating its global policies directly into the North America policy. Previously, the North America policy included guidance only on topics where LGIM's approach in the North American market differed from its Global Principles policies.

Diversity

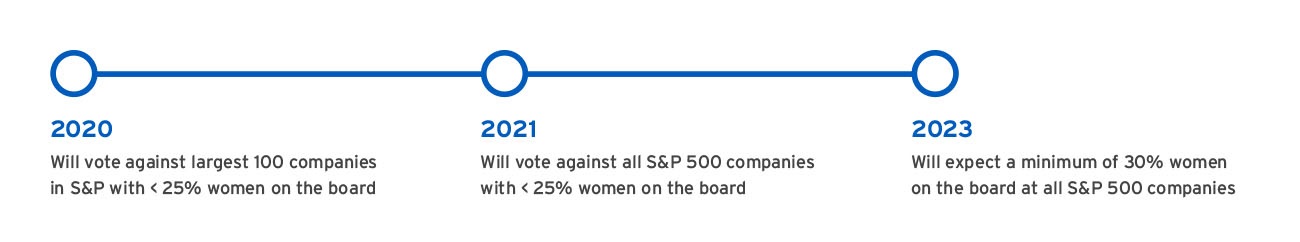

LGIM's updates to its 2019 North America policy reflects its evolving thinking on the topic of diversity, both at the board level and with respect to the management and employee population. At the board level, LGIM has updated its guidelines to set specific gender diversity targets. The policy will be implemented on a tiered basis beginning in 2020 by voting first against the largest 100 companies in the S&P2 with less than 25% women on the board; from 2021 it will vote against all S&P 500 companies with less than 25%; and ultimately it expects a minimum of 30% women by 2023. It also expects disclosure of procedures to find new members at both the board and senior management levels, and how those procedures ensure diversity. Based on data available as of May 23, 2019, it appears currently that 34 of the largest 100 companies would be impacted by this policy change, and that over 200 companies within the S&P 500 would be impacted.3

While many investors have expressed general expectations with respect to board diversity,4 LGIM's guidelines are one of the first to explicitly set meaningful targets or seek disclosure regarding diversity at

all levels of a company. Specifically, LGIM now expects its portfolio companies to disclose a breakdown of board directors, executives,5 managers and employees by geography, skill set and gender. In addition, while not expressing any targets with respect to ethnic diversity, it now expects companies to collect and report data on ethnicity at the board and senior management levels as expectations around facets of diversity continue to broaden.

Combined Chair/CEO Role

LGIM's guidelines provide clear

guidance with respect to its views of the division of responsibilities between board chairs and chief executive officers. As one of the chair's key roles is to challenge executives and encourage active participation by independent directors, LGIM believes combined roles can negatively impact culture, board discussions, compensation decisions and shareholder rights. To further drive its strong preference for separate chair and CEO roles, beginning in 2020 it will start to vote against the election or re-election of any director who holds a combined role.

Company Culture

LGIM's policies include a new section on company culture, articulating its expectation that boards undertake the assessment and measurement of culture. Furthermore, it seeks disclosure of this process. While culture has been a news headline and the focus of prominent investors, such as BlackRock's, 2019 engagement priorities, this is one of the first instances we have seen of investors' guidelines prescribing specific disclosure on this topic.

Sustainability Principles

LGIM views companies' management of ESG matters as an element of risk management and therefore as part of its fiduciary duties to its customers. In light of the importance it places on these matters, it has updated its policies to add color around how it incorporates sustainability principles within its voting and investment actions. Most notably, it provides that, effective immediately, where portfolio companies fail to meet its minimum standards of globally accepted business practices, as set out in LGIM's Future World Protection List, it will vote against the chair of the board.

LGIM developed the Future World Protection List in connection with its Future World range of funds, which are actively managed long-term focused funds that integrate ESG considerations throughout the investment process. The Future World Protection list criteria provide that, depending on the active or index nature of the Future World fund, it either does not hold or has significantly reduced exposure to, securities issued by companies that meet any of the following criteria:

- Involvement in the manufacture and production of controversial weapons

- Perennial violators of the UN Global Compact an initiative to encourage businesses worldwide to adopt sustainable and socially responsible practices6

- Companies solely involved in the extraction of coal.

LGIM will now vote against the board chairs of any companies that are:

- Involved in the manufacture or production of controversial weapons

- Perennial violators of the UN Global Compact

- Solely involved in the extraction of coal

LGIM is now expanding its use of these criteria beyond its Future World fund range as a basis for its voting decisions on board chairs.This policy change comes on the heels of LGIM's recent development of its own

ESG scoring system, which launched in 2018. To incentivize companies to "raise their standards," LGIM

publishes the scores of the companies it analyses on its website.

Overboarding

In its Global policy, LGIM has reduced the acceptable number of outside board seats that executives may hold from two to one, making this policy consistent with its existing North America policy.

Conclusion

As one of the largest asset managers, LGIM holds significant positions in many U.S. issuers. Given the detail its policies provide with respect to its ESG expectations and its sometimes-unique voice in the market, we recommend that its portfolio companies become familiar with these policies. We also note that LGIM publishes its voting decisions, including its rationale for votes against management, on its website, which provides issuers with clear insight into the application of LGIM's voting guidelines.

LGIM's Global and North America policies can be accessed here and here, respectively.

Learn how to conquer your ESG challenges.

If you have questions or comments, please email

info@georgeson.com or call 212 440 9800.

1 A review of LGIM's 2018 Active Ownership Report demonstrates its progressive approach. For example, the report indicates LGIM supported more shareholder resolutions on climate change than any of the world's 10 largest asset managers. The Report is available at https://corpgov.law.harvard.edu/wp-content/uploads/2019/05/Corporate_Governance_2019_long_digital.pdf.

2 LGIM will be looking to the S&P/TSX with respect to Canadian companies.

3 Based on board composition data provided by Equilar, Inc.

4 For example, see State Street Global Advisors' 2019 Proxy Voting and Engagement Guidelines and Vanguard's recently updated Proxy Voting Guidelines for U.S. Portfolio Companies. Georgeson's discussion of these updates is available at https://www.georgeson.com/us/state-street-global-advisors-2019-proxy-voting-policy-summary and https://www.georgeson.com/us/vanguard-2019-voting-policy-updates, respectively.

5 LGIM's guidelines note it is seeking this disclosure for both board directors and "executive directors," presumably because this policy comes directly from its Global guidelines, and portfolio companies within Europe have a two-tier board system. Accordingly, for the US we interpret this to mean executive officers.

6 Participation in the UN Global Compact is voluntary and open to any company – other than those excluded due to sanctions, ethical violations, the production or manufacture of tobacco or business related to antipersonnel landmines or cluster bombs – committed to work towards implementation of the Compact's ten principles, which are normative principles to guide responsible business policy and conduct relating to four areas: human rights, labor, the environment and anti-corruption. These principles are separate from, but foundational to, the UN's 17 Sustainable Development Goals, which seek to "solve societal challenges through business innovation and collaboration." A helpful discussion of the relationship between the Ten Principles and the Sustainable Development Goals is available at https://www.unglobalcompact.org/docs/about_the_gc/White_Paper_Principles_SDGs.pdf.